Understanding Market Volatility

Market volatility refers to the degree of variation in the price of a financial instrument over time. It is often measured by the standard deviation of returns or through the VIX (Volatility Index), commonly known as the "fear gauge" of the stock market. High volatility signals significant price fluctuations, while low volatility suggests a stable market.

Volatility is a normal part of financial markets. While it can create opportunities for traders, it can also trigger anxiety among long-term investors. Understanding volatility can help market participants make informed decisions without panicking during market downturns.

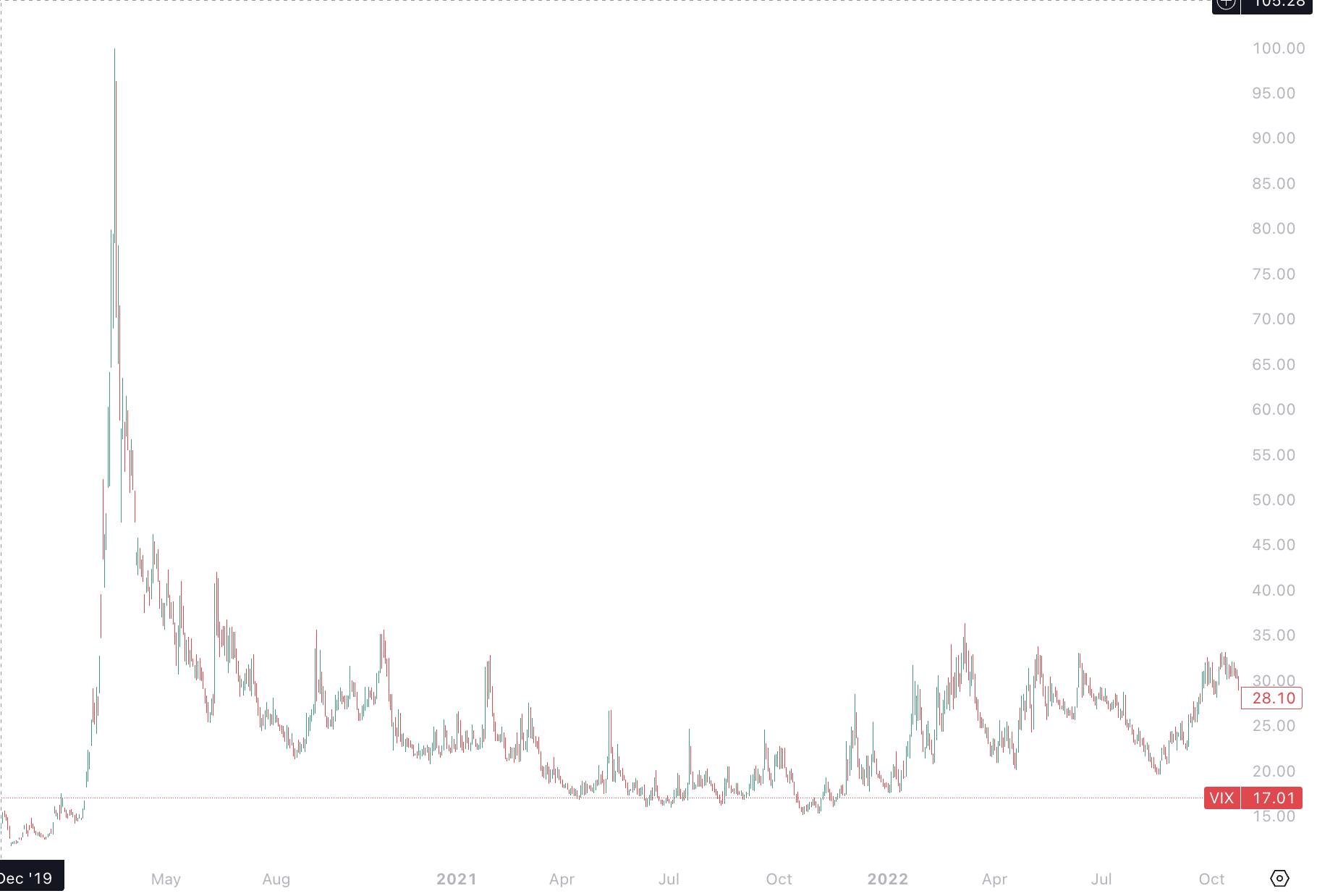

Volatility Index

Key Indicators of Market Volatility

- VIX Index – Measures market expectations of volatility based on S&P 500 index options.

- Stock Market Corrections – A decline of 10% or more from a recent market high.

- Bear Markets – A prolonged decline of 20% or more in stock prices.

- Economic and Political Events – Uncertainty from policy changes, economic downturns, or global crises can impact market stability.

- Interest Rate Changes – Decisions by central banks, such as the Federal Reserve, influence investor sentiment.

Market Volatility Factors

What Causes Market Volatility?

Several factors contribute to fluctuations in the market, including:

- Macroeconomic Factors – Inflation, GDP growth, unemployment rates, and monetary policy.

- Geopolitical Risks – Wars, trade tensions, and elections can create uncertainty.

- Corporate Earnings Reports – Positive or negative earnings surprises influence stock prices.

- Speculative Trading & Algorithmic Trading – Rapid buy/sell decisions amplify price swings.

- Supply & Demand Dynamics – Investor sentiment and trading volumes contribute to price movements.

How to Stay Calm During Market Crashes

Market crashes can be distressing, but staying calm and maintaining a long-term perspective is crucial. Here are practical strategies to help navigate market downturns:

- Understand Market Cycles

- Markets move in cycles, alternating between bull and bear phases. Recognizing this pattern can help investors stay composed during downturns.

- Maintain a Diversified Portfolio

- Diversification across asset classes (stocks, bonds, commodities, real estate) reduces risk. Holding international investments also helps hedge against regional downturns.

- Avoid Panic Selling

- Selling investments out of fear can lock in losses. Historical data shows that markets tend to recover over time, rewarding patient investors.

- Focus on Fundamentals

- Instead of reacting to daily price movements, evaluate companies based on earnings, growth potential, and industry trends.

- Stick to Your Investment Plan

- Having a clear investment strategy and risk tolerance helps prevent emotional decision-making. Rebalancing your portfolio periodically ensures alignment with your financial goals.

- Take Advantage of Buying Opportunities

- Market downturns often present opportunities to buy quality assets at discounted prices. Consider dollar-cost averaging to invest consistently over time

- Limit Media Consumption

- Constant exposure to negative financial news can increase stress. Focus on reliable sources and avoid excessive trading based on fear-driven headlines.

- Consult a Financial Advisor

- If uncertainty is overwhelming, speaking with a professional can provide clarity and reinforce disciplined investing.

Historical Perspective: Market Recoveries

Despite short-term crashes, the market has historically trended upward over the long run. Consider these examples:

- 2008 Financial Crisis: The S&P 500 dropped nearly 50% but rebounded strongly within a few years.

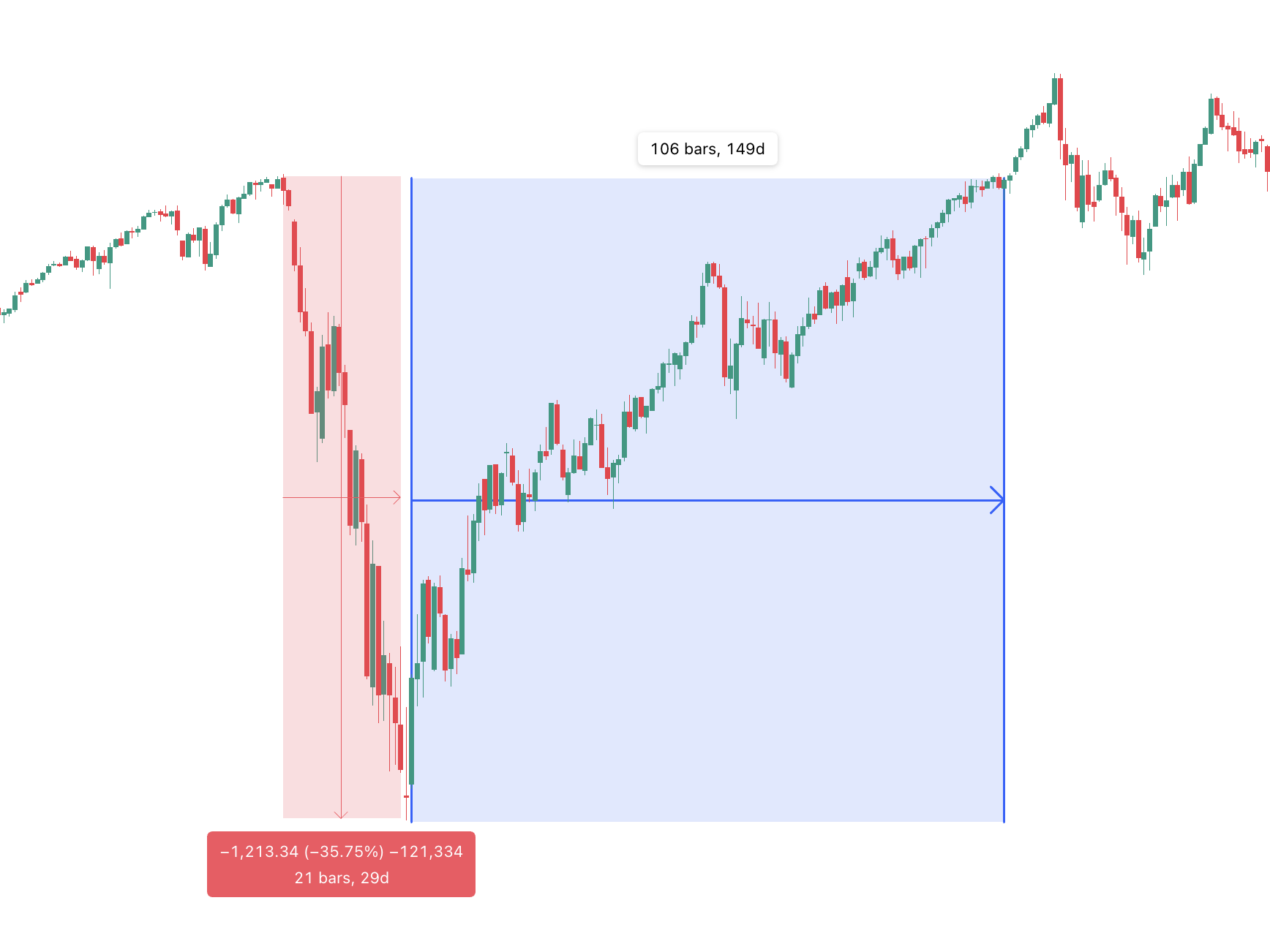

- COVID-19 Crash (2020): The market fell over 30% in March but reached new highs by the end of the year.

- Dot-Com Bubble (2000-2002): Tech stocks collapsed, but the broader market recovered as new industries emerged.

COVID-19 Crash (2020)

Final Thoughts

Market volatility is an unavoidable aspect of investing, but it does not have to dictate your financial future. By understanding the causes of volatility and implementing disciplined investment strategies, you can navigate market fluctuations with confidence. Remember, patience and a long-term perspective are the keys to successful investing.