Want to invest but worried about market ups and downs?

Timing the stock market is nearly impossible, and trying to invest at the "right" moment can be stressful. Luckily, there's an easy strategy to help you build wealth over time without the stress.

Enter Dollar Cost Averaging (DCA)—a simple, steady way to invest that reduces risk and keeps you on track.

What Is Dollar Cost Averaging (DCA)?

Dollar Cost Averaging (DCA) is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. Instead of trying to buy low and sell high, you spread out your purchases over time, reducing the impact of market fluctuations.

Dollar Cost Averaging

Breaking It Down with an Example

Let’s say you decide to invest $200 every month into an index fund:

After four months, you have invested a total of $800 and own 16 shares. The average price you paid per share is $50($800 ÷ 16 shares), even though the share price fluctuated between $40 and $66.67.

This is how DCA helps reduce the risk of investing all at once at a potentially high price. Instead of worrying about timing the market, you accumulate shares at an average price over time, which helps balance out the effects of short-term market volatility.

Why Use Dollar Cost Averaging?

DCA is popular among investors because it provides multiple benefits:

1. Reduces the Risk of Market Volatility

Markets go up and down, and trying to predict their movements is tough. By investing regularly, you avoid putting all your money in at a high point.

2. Removes Emotion from Investing

Many investors panic when the market drops and hesitate when it rises. DCA keeps your investments consistent, helping you stay disciplined and avoid emotional decision-making.

3. Makes Investing More Accessible

You don’t need a large sum to start investing. With DCA, you can invest small amounts regularly, making it easier to grow your portfolio over time.

4. Encourages Long-Term Wealth Building

Since DCA is a slow and steady approach, it aligns well with long-term investing goals. Whether you’re saving for retirement or another financial milestone, DCA helps you stay invested and reap the benefits of compounding growth.

How to Implement Dollar Cost Averaging

Starting with DCA is simple:

- Choose an Investment – Most people use DCA for index funds, ETFs, or stocks.

- Set a Fixed Amount – Decide how much you’ll invest regularly (e.g., $100 per week or $500 per month).

- Stick to a Schedule – Invest at consistent intervals (weekly, biweekly, or monthly).

- Automate Your Investments – Set up automatic deposits to stay consistent and avoid second-guessing yourself.

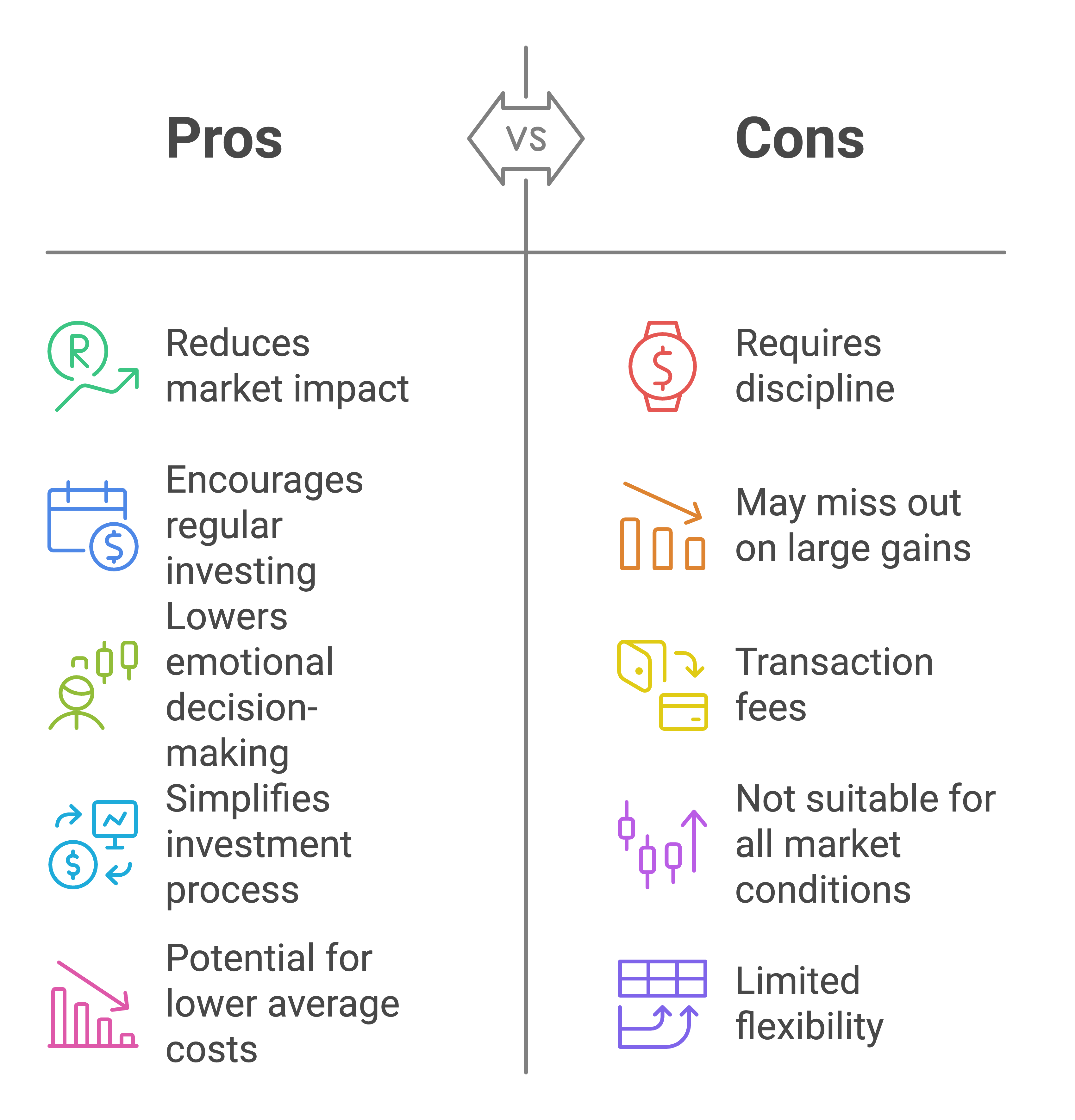

Dollar Cost Averaging vs. Lump-Sum Investing

Some investors prefer to invest a large sum all at once instead of using DCA. Here’s how they compare:

| Strategy | Pros | Cons |

|---|---|---|

| Dollar Cost Averaging (DCA) | Reduces risk, removes emotion, builds discipline | Might miss out on higher returns if market goes up |

| Lump-Sum Investing | Historically higher returns if invested at the right time | Higher risk if market drops soon after investing |

If you have a large sum, research suggests that investing it all at once often leads to higher returns. But if market timing makes you nervous, DCA is a safer, more stress-free approach.

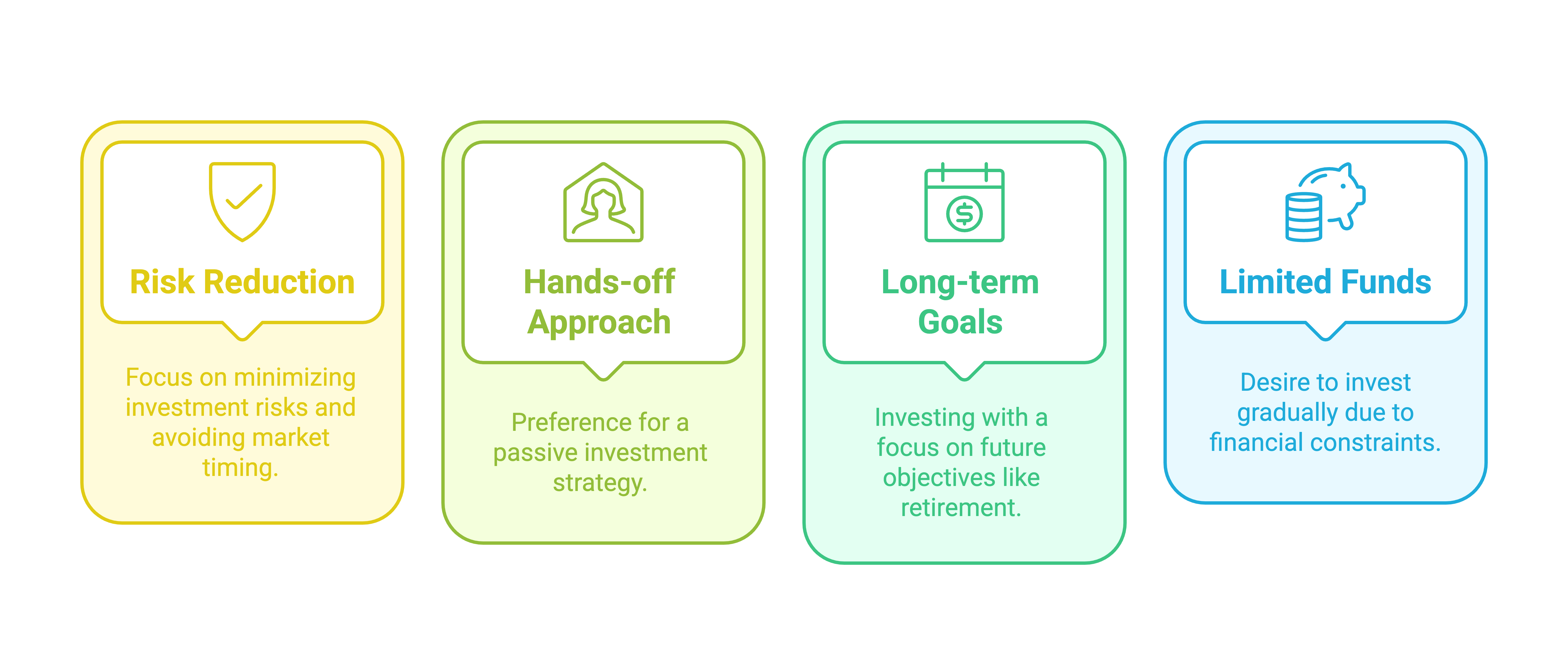

Is DCA Right for You?

DCA works best if:

- You want to reduce risk and avoid market timing.

- You prefer a hands-off investment approach.

- You’re investing for long-term goals like retirement.

- You have limited funds and want to invest gradually.

Investment Preferences

If you’re comfortable with short-term market swings and want the highest potential returns, lump-sum investing may be a better option.

Final Thoughts

Dollar Cost Averaging (DCA) is a simple, low-stress way to invest. By making regular investments over time, you reduce risk, build discipline, and set yourself up for long-term financial growth.

Want to keep learning? Check out our Beginner’s Guide to Investing to explore more strategies. Or download our free stock market guide! Ready to start? Set up your automated investments today and let time do the work for you!