Stock buybacks, also known as share repurchases, occur when a company buys back its own shares from the open market. This reduces the number of outstanding shares, consolidating ownership and often boosting stock prices. While buybacks can benefit shareholders in multiple ways, they also come with potential drawbacks. In this article, we explore how stock buybacks work, their advantages and disadvantages, and their broader economic implications.

How Do Stock Buybacks Work?

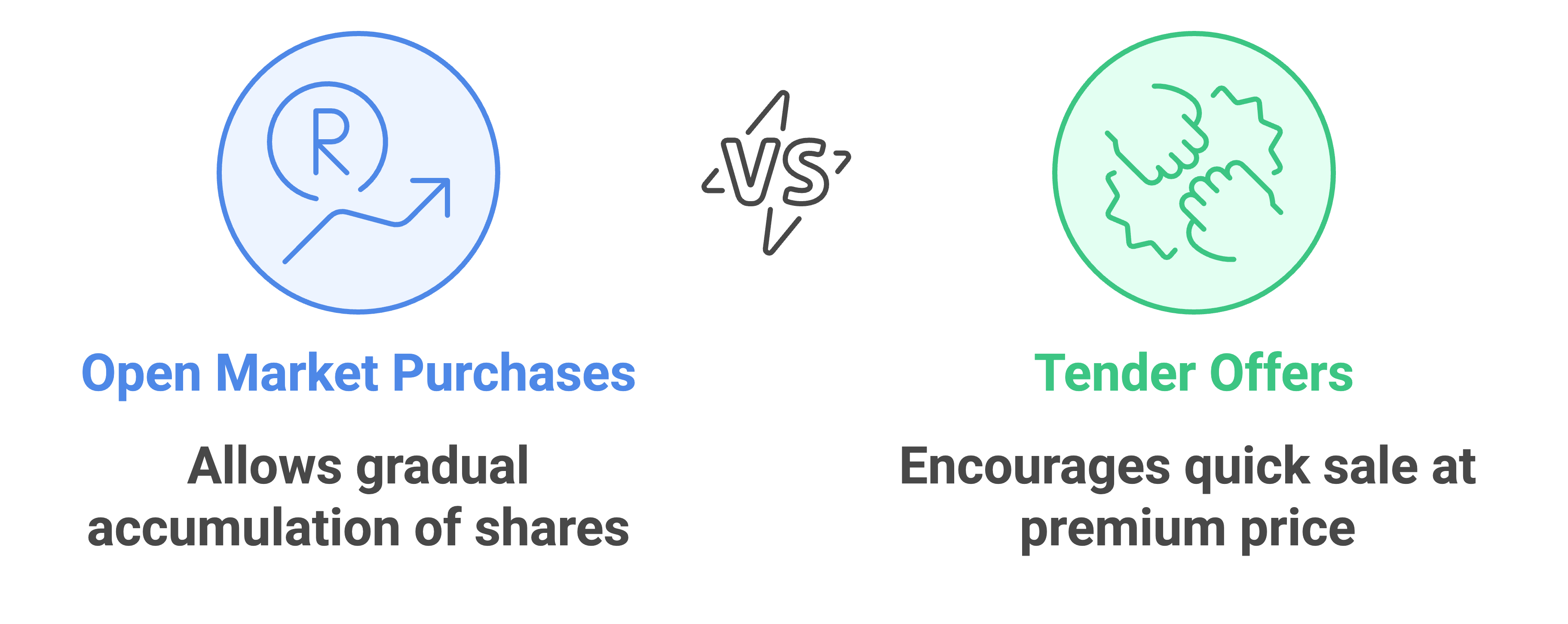

A stock buyback happens when a company repurchases its own shares using its profits or borrowed funds. There are two primary methods through which companies conduct buybacks:

- Open Market Purchases – The company buys shares from the stock market just like any other investor.

- Tender Offers – The company offers to buy shares from shareholders at a predetermined price, usually above the market rate, encouraging investors to sell their holdings.

How Do Stock Buybacks Work?

By repurchasing shares, a company reduces the number of shares in circulation, which can impact financial metrics and investor returns.

Why Do Companies Buy Back Stock?

Companies repurchase their own stock for several reasons:

- Boosting Stock Prices

When a company reduces its share count, its earnings per share (EPS) increase, making the stock appear more valuable. Investors often react positively to buybacks, causing share prices to rise. - Returning Capital to Shareholders

Instead of paying dividends, companies can return value to investors through buybacks. This benefits shareholders who prefer capital gains over dividend income, which may be taxed at a higher rate. - Offsetting Dilution

Companies that issue stock options to employees or conduct mergers using stock can experience dilution. Buybacks help offset this by reducing the total number of shares outstanding. - Indicating Confidence

A company repurchasing its own stock signals to the market that it believes in its own future growth, which can boost investor confidence. - Optimizing Capital Structure

Firms with excess cash may use buybacks to optimize their balance sheets, especially when they have no immediate investment opportunities.

Effects of Stock Buybacks on Shareholders

Stock buybacks impact shareholders in various ways, both positively and negatively.

Positive Effects

- Increased Earnings Per Share (EPS) – With fewer shares in circulation, EPS rises, making the stock more attractive to investors.

- Higher Stock Prices – Buybacks can drive up demand, increasing share prices and benefiting existing shareholders.

- Tax Efficiency – Compared to dividends, buybacks may be more tax-efficient as they allow investors to defer taxes until they sell shares.

- Flexibility – Unlike dividends, which create an expectation of regular payouts, buybacks offer companies flexibility in returning capital.

Positive Effects of Stocks Buybacks

Negative Effects

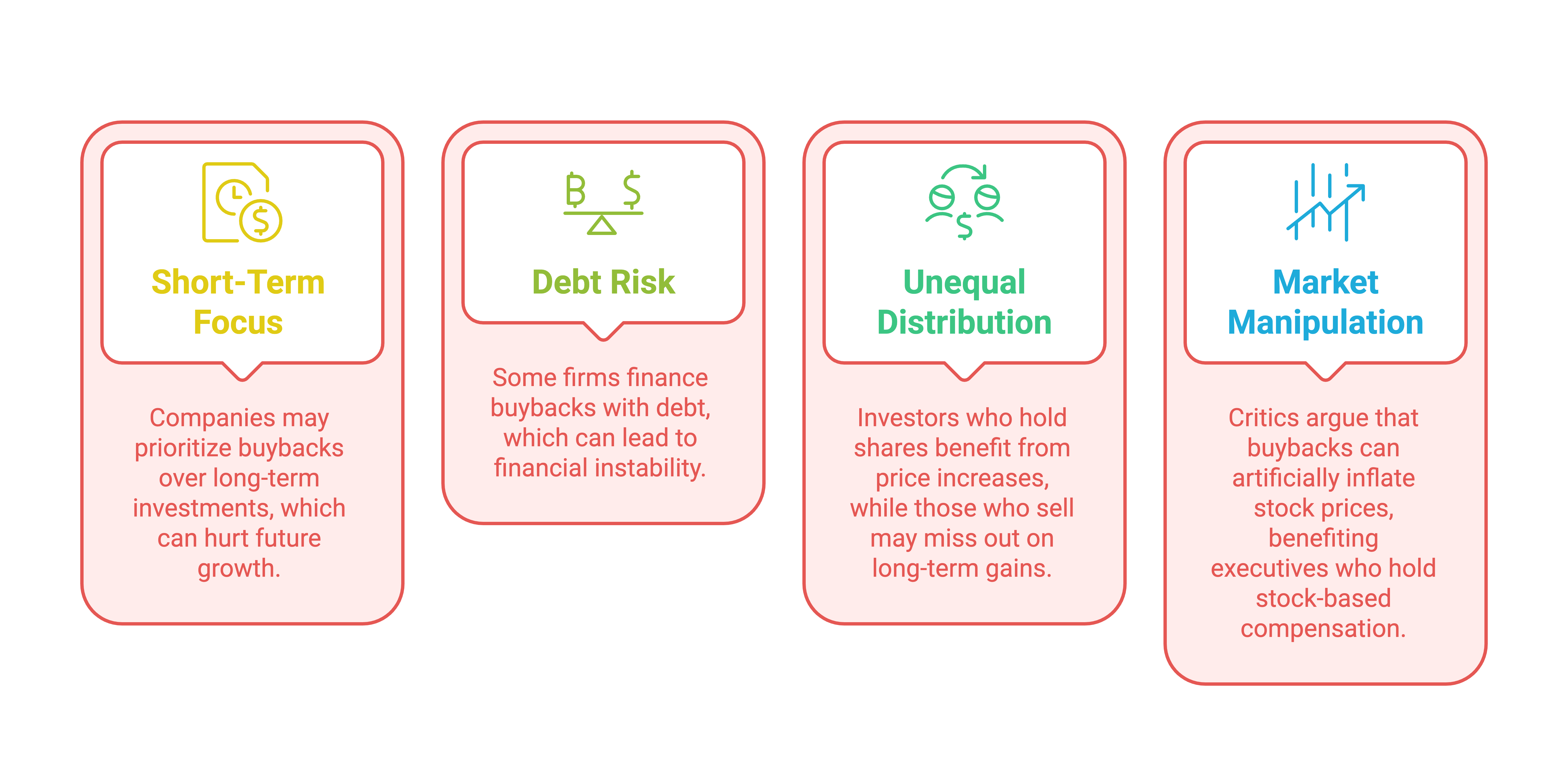

- Short-Term Focus – Companies may prioritize buybacks over long-term investments, which can hurt future growth.

- Debt Risk – Some firms finance buybacks with debt, which can lead to financial instability.

- Unequal Distribution of Benefits – Investors who hold shares benefit from price increases, while those who sell may miss out on long-term gains.

- Market Manipulation Concerns – Critics argue that buybacks can artificially inflate stock prices, benefiting executives who hold stock-based compensation.

Negative Effects of Stocks Buybacks

The Broader Economic Impact of Stock Buybacks

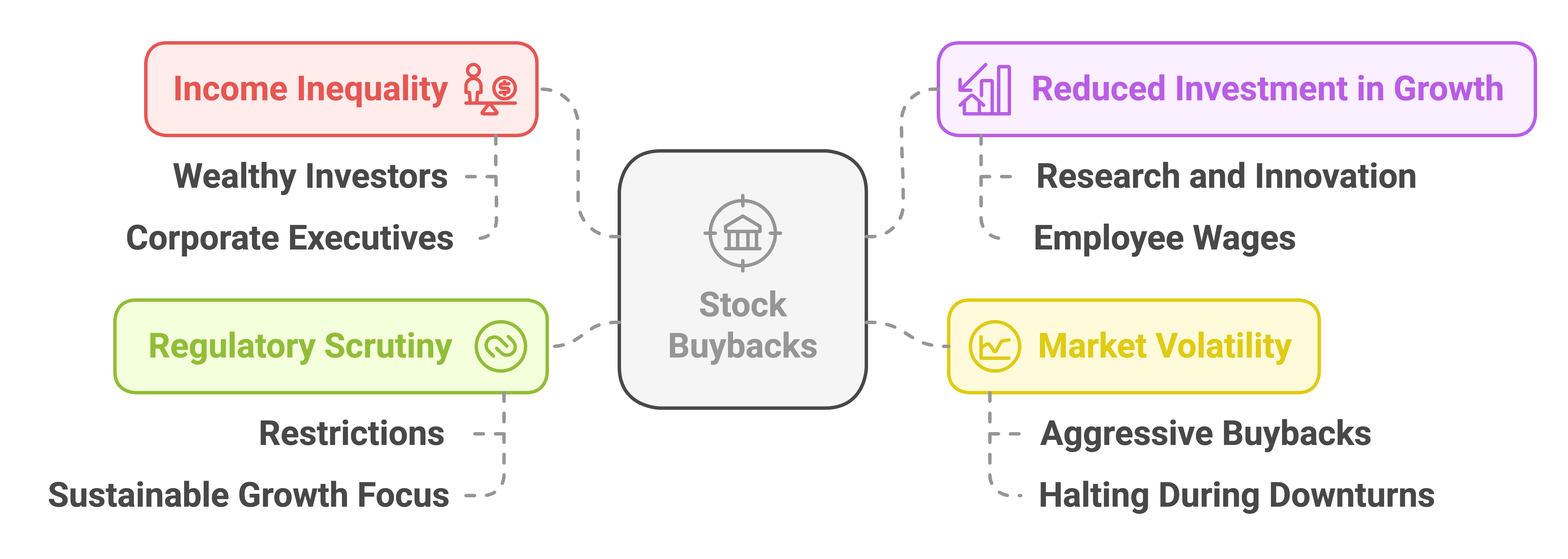

The impact of stock buybacks extends beyond individual shareholders and affects the economy in significant ways:

- Income Inequality

Buybacks often benefit wealthy investors and corporate executives who own large stock holdings, widening income disparities. - Reduced Investment in Growth

Companies spending billions on buybacks may neglect investments in research, innovation, and employee wages, potentially stalling long-term growth. - Market Volatility

Excessive buybacks can contribute to stock market fluctuations, as companies may repurchase shares aggressively in good times and halt buybacks during downturns. - Regulatory Scrutiny

Governments and regulators have debated imposing restrictions on buybacks to ensure companies prioritize sustainable growth over short-term stock price increases.

Economic Impact of Stock Buybacks

Conclusion

Stock buybacks are a powerful financial tool that can enhance shareholder value, boost stock prices, and optimize capital allocation. However, they also present risks such as reduced long-term investments and potential financial instability. While buybacks benefit existing shareholders, they can also exacerbate income inequality and market volatility. Investors should analyze a company’s buyback strategy in conjunction with its financial health and long-term growth prospects before making investment decisions.