What Is Compounding?

Compounding is like a financial snowball. It starts small, but over time, as it picks up speed, it grows bigger and bigger. In simple terms, compounding is the process where your investments generate earnings, and those earnings are reinvested to generate even more earnings. This cycle continues, leading to exponential financial growth.

How Compounding Works

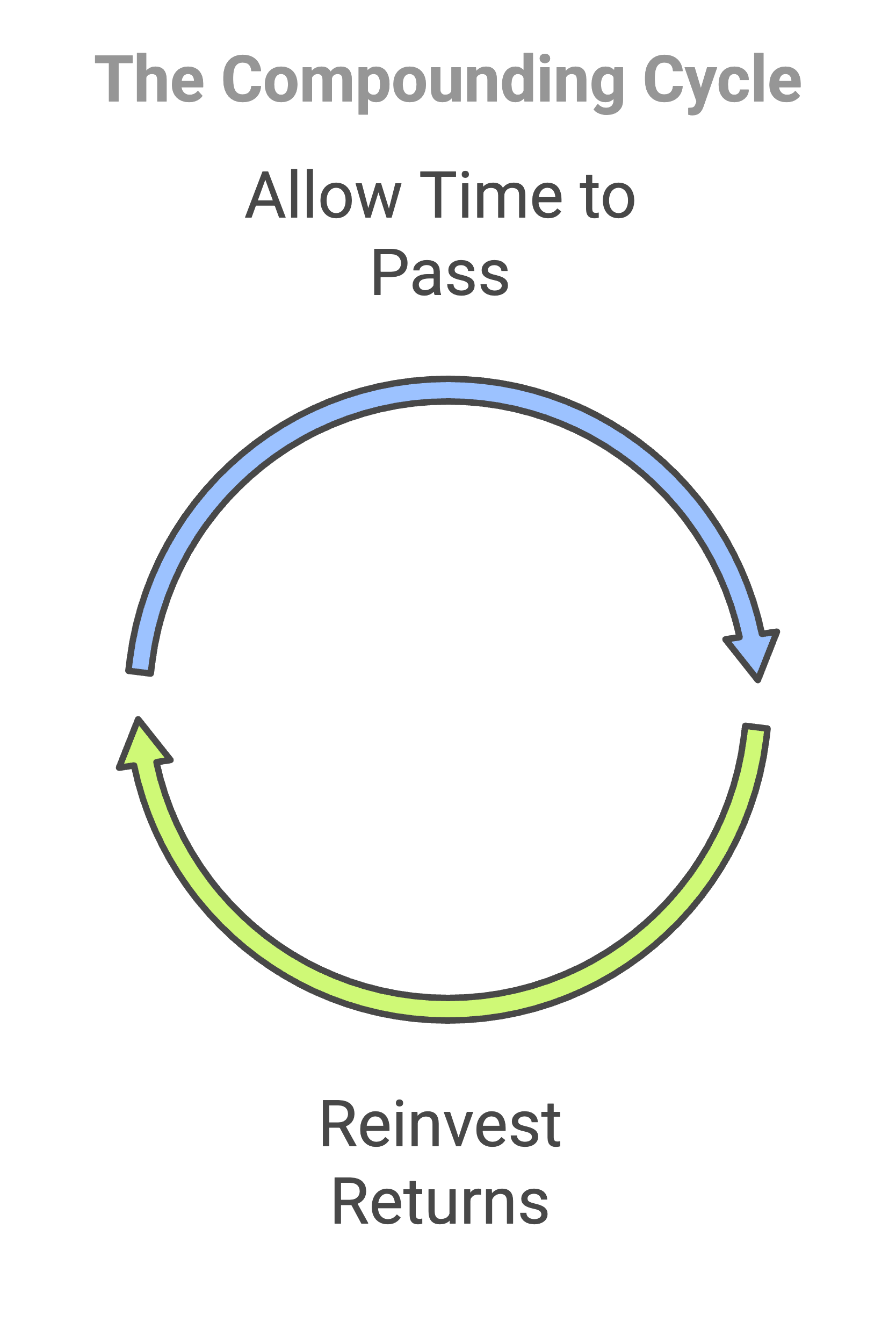

There are two key factors that make compounding work:

- Time – The longer you let your money grow, the more powerful compounding becomes.

- Reinvestment – By reinvesting your returns instead of cashing them out, your money continues to multiply.

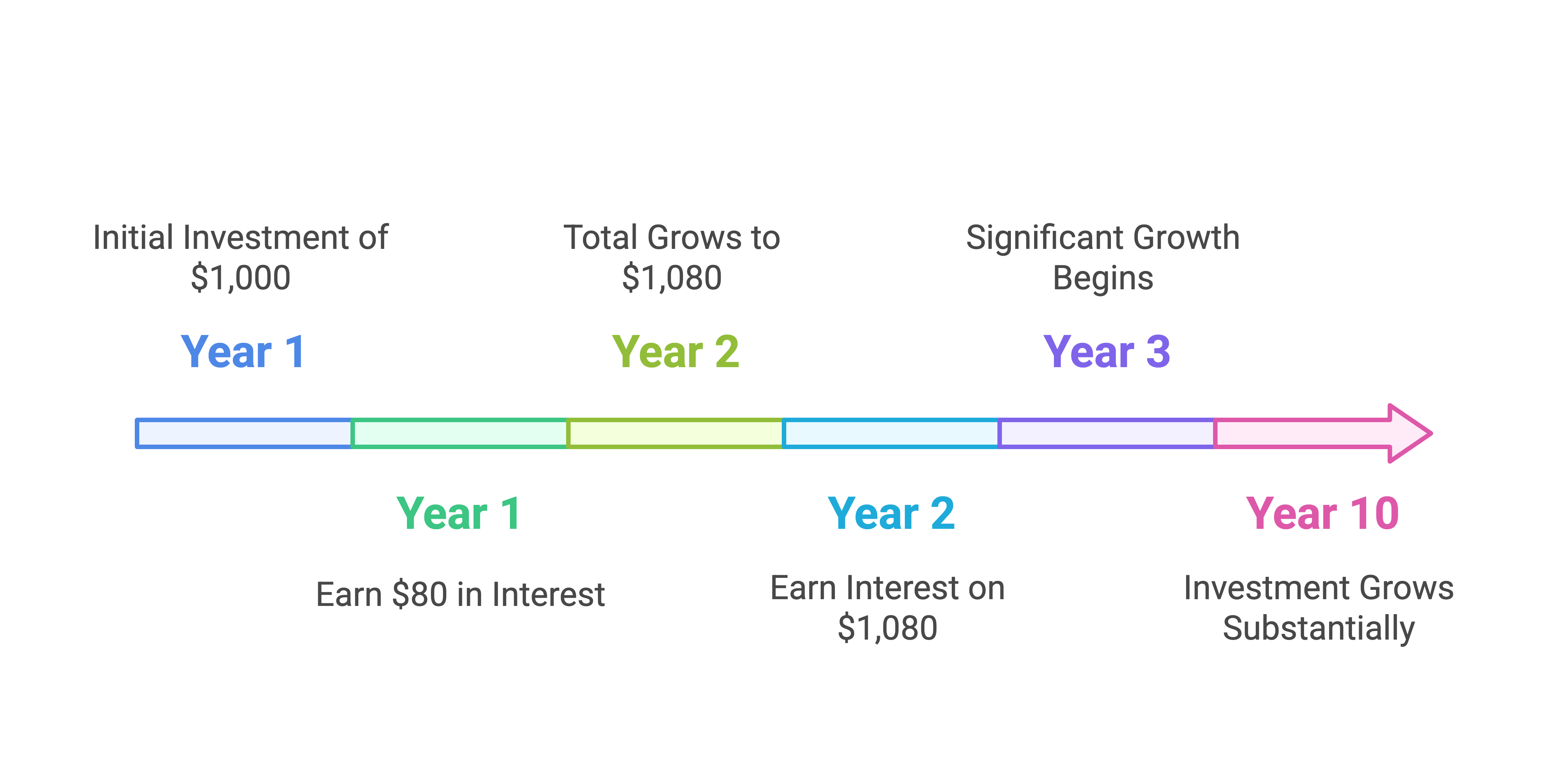

For example, let’s say you invest $1,000 at an annual return of 8%. In the first year, you earn $80 in interest, making your total $1,080. In the second year, you earn interest not just on your original $1,000 but also on the $80 from the first year. This compounding effect continues, and over decades, your investment grows substantially.

The Compounding Cycle

The Power of Compounding: A Decade of Growth

The Role of Reinvesting Dividends

Many stocks and funds offer dividends—regular payouts to investors. If you take these dividends as cash, you get a steady income. But if you reinvest them, you buy more shares, which then generate even more dividends. Over time, this reinvestment leads to massive growth.

For instance, let’s say you invest in a stock that pays a 4% dividend yield. Instead of taking the cash, you reinvest it. Each year, you own more shares, and your dividends increase as well. This simple step can supercharge your wealth-building potential.

Why Starting Early Matters

The earlier you start investing, the more time your money has to compound. Consider these two scenarios:

- Investor A starts investing $200 per month at age 25.

- Investor B starts investing $400 per month at age 40.

Even though Investor B is investing twice as much, Investor A will likely end up with more money at retirement because their money had more time to grow. This is the power of compounding in action!

The Formula for Compounding

The math behind compounding is simple but powerful. The compound interest formula is:

A = P (1 + r/n)^(nt)

Where:

- A = Future value of investment

- P = Initial investment

- r = Annual interest rate (decimal form)

- n = Number of times interest is compounded per year

- t = Number of years

Even small contributions can result in significant wealth when given enough time.

The Key to Wealth Creation

Stay Consistent

The biggest mistake investors make is stopping or withdrawing their investments too soon. The longer your money stays invested, the more powerful compounding becomes.

Avoid Unnecessary Withdrawals

Every time you withdraw from your investments, you break the compounding cycle. Try to keep your investments untouched for as long as possible.

Choose the Right Investments

Not all investments compound at the same rate. Look for assets that have a history of consistent growth, such as index funds, blue-chip stocks, and dividend-paying stocks.

Final Thoughts

Compounding is one of the most powerful tools in wealth creation. It doesn’t require luck, huge amounts of money, or fancy strategies—just time, patience, and consistency. The sooner you start, the better. So, what are you waiting for? Start investing today and let compounding work its magic!