Introduction

Technical analysis (TA) is a critical methodology traders use to evaluate securities and forecast future price movements based on historical market data, primarily price and volume. Unlike fundamental analysis, which examines economic and financial factors, technical analysis focuses on identifying patterns, trends, and indicators that help traders make informed decisions.

This comprehensive guide explores the principles, tools, indicators, and strategies of technical analysis, helping traders enhance their trading skills and maximize profits while minimizing risks.

1. Understanding Technical Analysis

What is Technical Analysis?

Technical analysis is the study of historical price movements, volume, and market-driven indicators to predict future price behavior. Traders utilize this method to identify trading opportunities and execute trades with precision.

Core Assumptions of Technical Analysis

Technical analysis is built on three key principles:

- Market Prices Reflect All Information

- This assumption suggests that all relevant information—economic data, company performance, and market sentiment—is already incorporated into an asset’s price.

- Price Moves in Trends

- Price movements follow identifiable trends, and once a trend is established, it is likely to continue unless a reversal occurs.

- History Repeats Itself

- Market psychology plays a crucial role in price movements. Since human behavior remains consistent, past patterns often recur.

2. Key Components of Technical Analysis

Types of Charts Used in Technical Analysis

Charts are the foundation of technical analysis and help traders visualize price movements.

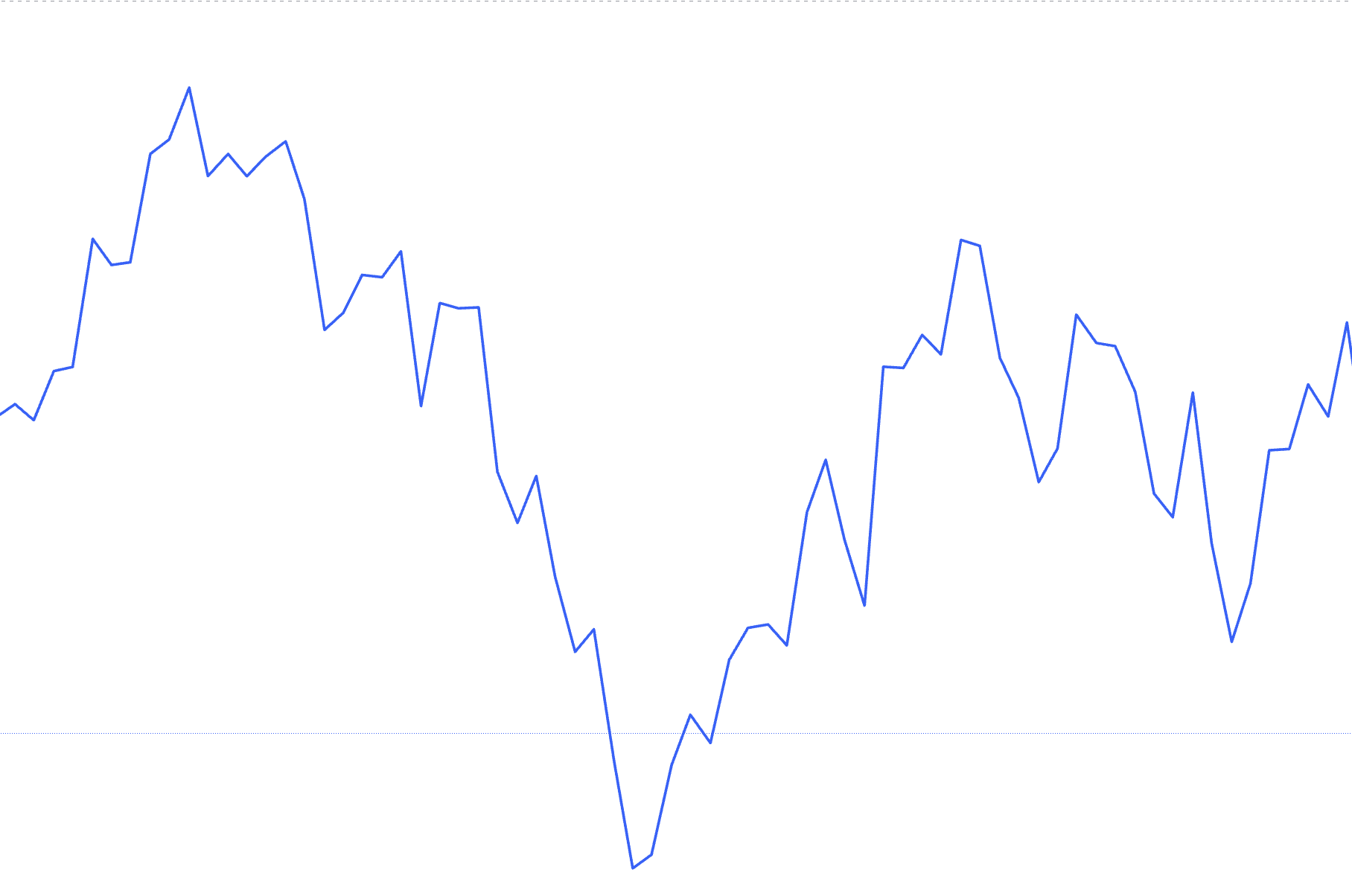

- Line Charts: Represent price movements using a single line connecting closing price

- Bar Charts: Display open, high, low, and close (OHLC) prices, offering a detailed view of price action.

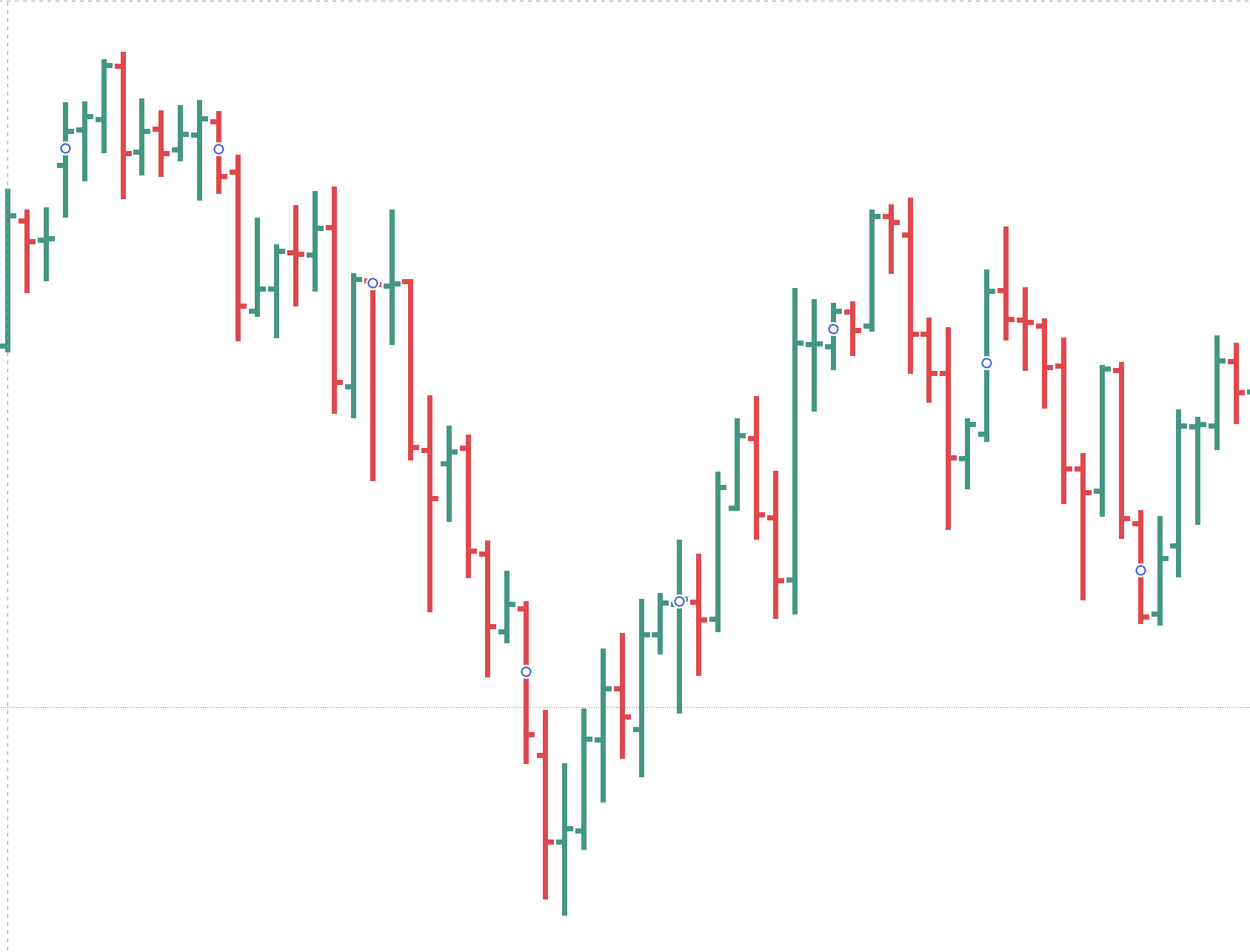

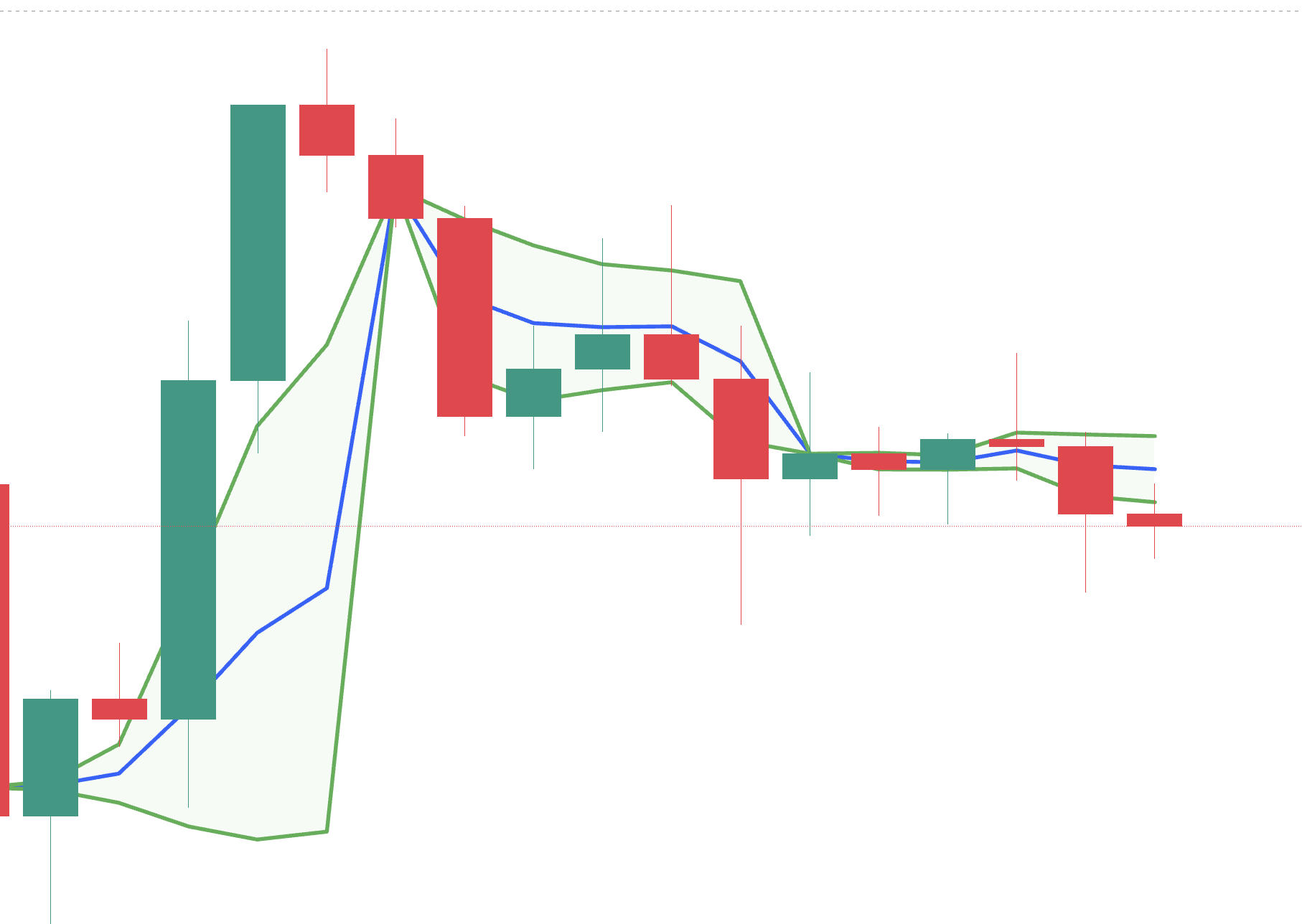

- Candlestick Charts: Provide the same OHLC information but with color-coded bodies that distinguish bullish and bearish price movements.

Line Chart

Bar Chart

Chandle Chart

Trends and Market Phases

Traders identify trends to determine market direction:

- Uptrend: Higher highs and higher lows indicate bullish momentum.

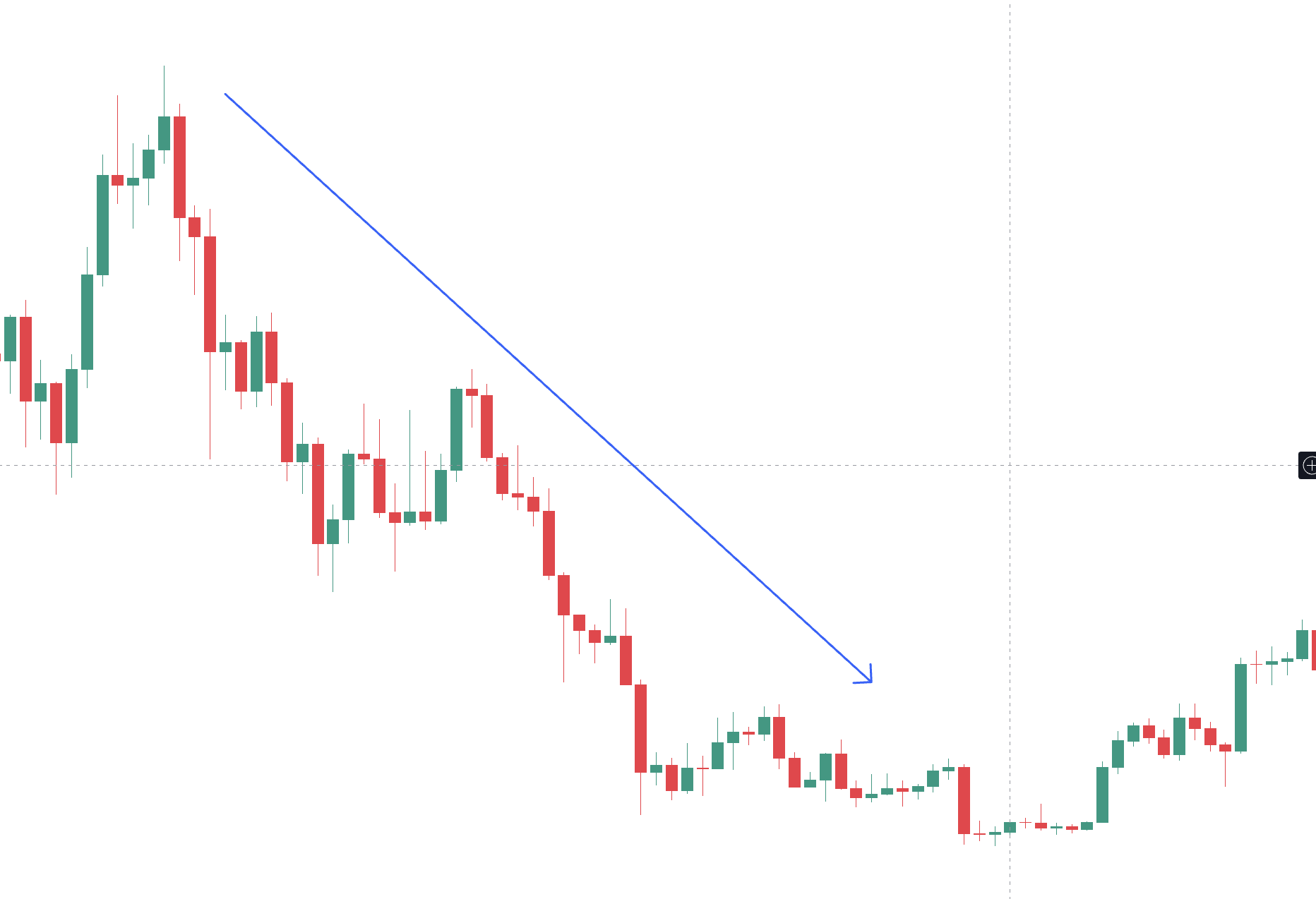

- Downtrend: Lower highs and lower lows indicate bearish momentum.

- Sideways Trend: Prices move within a defined range, showing market consolidation.

Uptrend

Downtrend

Sideways

Market phases:

- Accumulation Phase – Institutional investors accumulate positions before a new trend begins.

- Advancing (Mark-Up) Phase – Prices rise as more traders enter the market.

- Distribution Phase – Large investors start selling their positions, leading to price stabilization.

- Declining (Mark-Down) Phase – Prices drop as the downtrend begins.

Accumulation

Advancing (Mark-Up)

Distribution

Declining (Mark-Down)

Support and Resistance Levels

- Support Level: A price level where buying pressure prevents further decline.

- Resistance Level: A price level where selling pressure prevents further price increases.

Support

Resitance

Support and resistance levels help traders identify entry and exit points.

3. Technical Indicators and Oscillators

Technical indicators provide quantitative insights into price movements, helping traders confirm trends and identify reversals.

Trend-Following Indicators

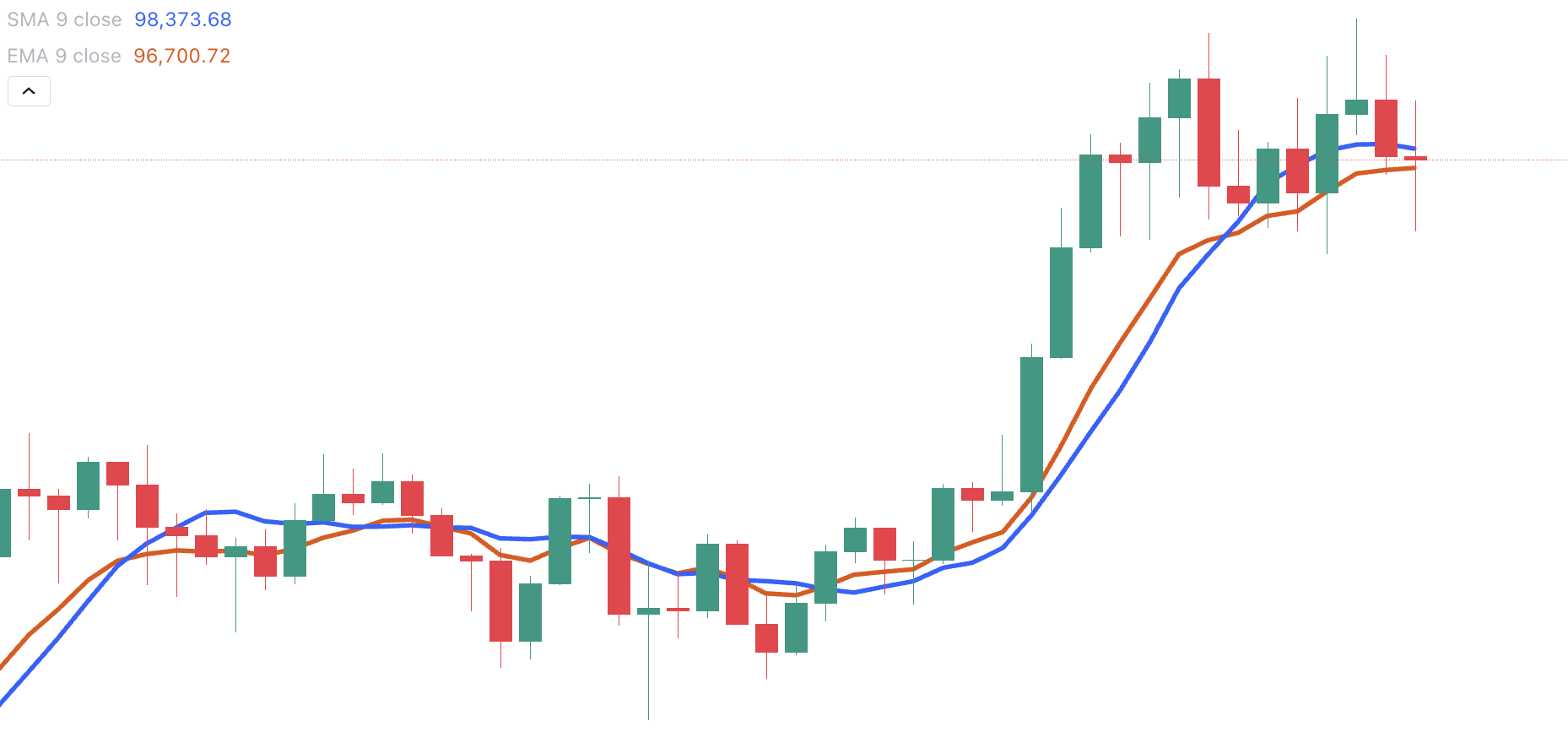

- Moving Averages (MA)

- Simple Moving Average (SMA): Calculates the average price over a specific period.

- Exponential Moving Average (EMA): Assigns greater weight to recent prices, making it more responsive.

- Moving Average Convergence Divergence (MACD)

- A momentum indicator that identifies trend direction and reversals using two EMAs and a histogram.

- Bollinger Bands

- A volatility indicator consisting of a middle moving average band and two outer bands representing standard deviations.

Moving Average

Moving Average Convergence Divergence

Bollinger Bands

Momentum Indicators

- Relative Strength Index (RSI)

- Measures the magnitude of recent price changes to determine overbought (>70) or oversold (<30) conditions.

- Stochastic Oscillator

- Compares a security’s closing price to its price range over a period to gauge momentum strength.

Relative Strength Index

Stochastic Oscillator

Volume Indicators

- On-Balance Volume (OBV)

- A cumulative measure of buying and selling pressure based on volume.

- Volume Weighted Average Price (VWAP)

- An intraday indicator that calculates the average price weighted by volume.

On-Balance Volume

Volume Weighted Average Price

4. Chart Patterns and Their Significance

Continuation Patterns

- Flags and Pennants

- Short-term patterns indicating a brief consolidation before the previous trend resumes.

- Ascending and Descending Triangles

- Suggest a continuation of the trend upon breakout.

- Cup and Handle

- A bullish continuation pattern signaling an upcoming price increase.

Flag

Cup and Handle

Reversal Patterns

- Head and Shoulders

- A classic pattern indicating trend reversal.

- Double Top and Double Bottom

- Double tops signal bearish reversals, while double bottoms indicate bullish reversals.

- Wedges

- Rising and falling wedges indicate potential reversals.

5. Trading Strategies Using Technical Analysis

- Trend Following Strategy

- Uses moving averages, MACD, and trendlines to follow prevailing trends.

- Breakout Trading Strategy

- Identifies key support/resistance levels and trades when price breaks out.

- Mean Reversion Strategy

- Assumes price will revert to its mean, using Bollinger Bands and RSI.

- Momentum Trading Strategy

- Focuses on stocks with strong price movements using RSI and MACD.

- Swing Trading Strategy

- Takes advantage of short-term price swings.

6. Limitations and Risks of Technical Analysis

Technical analysis is not foolproof and has limitations:

- Subjectivity – Different traders may interpret charts differently.

- Lagging Indicators – Some indicators react after price movements occur.

- Market Conditions – Unforeseen news can disrupt patterns.

- False Signals – Indicators can generate misleading signals.

7. Advanced Technical Analysis Concepts

- Fibonacci Retracement

- Identifies potential support and resistance levels based on Fibonacci ratios.

- Elliott Wave Theory

- Suggests that markets move in predictable five-wave impulse and three-wave corrective patterns.

- Divergence Trading

- Uses RSI, MACD, or Stochastic Oscillator to identify discrepancies between price and indicator trends, signaling potential reversals.

8. Conclusion

Technical analysis is a powerful tool for traders, offering insights into market trends, momentum, and potential reversals. Mastering charts, indicators, and patterns enhances trading success. However, traders should combine technical analysiswith risk management and remain adaptable to changing market conditions.

Whether you’re a beginner or an experienced trader, continuous learning and disciplined strategy execution are essential for long-term profitability in financial markets.