P/E Ratio, EPS, and Other Must-Know Stock Market Metrics

Investing in the stock market requires a strong understanding of financial metrics and ratios. These metrics help investors evaluate a company's financial health, profitability, and potential growth. Among the most commonly used are the Price-to-Earnings (P/E) Ratio and Earnings Per Share (EPS), but many other important ratios can also provide valuable insights. This guide will break down key stock market metrics that every investor should know.

1. Price-to-Earnings (P/E) Ratio

The P/E ratio measures how much investors are willing to pay for a company’s earnings. It is calculated using the formula:

Price-to-Earnings (P/E) Ratio

Why It Matters:

- A high P/E ratio may indicate that investors expect strong future growth.

- A low P/E ratio may suggest the stock is undervalued or that the company is facing challenges.

- It is useful for comparing companies within the same industry.

Types of P/E Ratios:

- Trailing P/E – Uses past earnings (last 12 months).

- Forward P/E – Uses projected future earnings.

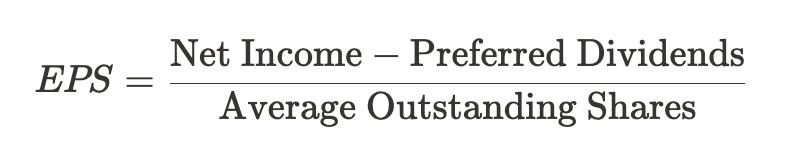

2. Earnings Per Share (EPS)

EPS represents a company’s profitability per share. It is calculated as:

Earnings Per Share (EPS)

Why It Matters:

- Higher EPS generally indicates better profitability.

- Helps compare profitability among companies in the same sector.

- Used in the P/E ratio calculation.

Types of EPS:

- Basic EPS – Uses outstanding shares.

- Diluted EPS – Accounts for convertible securities (e.g., stock options).

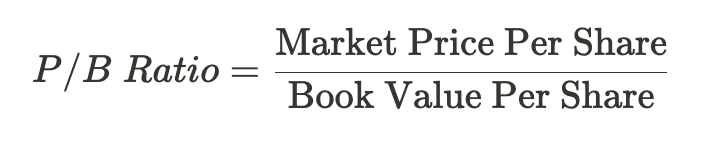

3. Price-to-Book (P/B) Ratio

The P/B ratio compares a company's market price to its book value (assets minus liabilities). It is calculated as:

Price-to-Book (P/B) Ratio

Why It Matters:

- A P/B ratio below 1 suggests the stock may be undervalued.

- A high P/B ratio may indicate a company with strong growth prospects.

- Best for analyzing asset-heavy companies (e.g., banks, real estate).

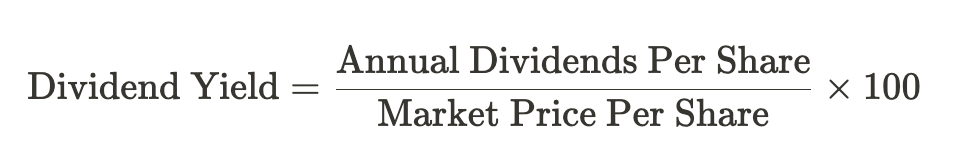

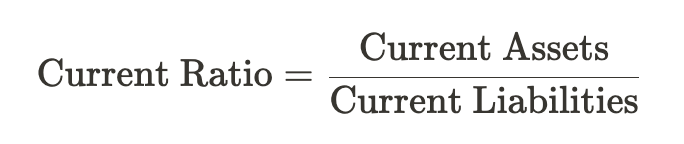

4. Dividend Yield

Dividend yield measures the return investors receive from dividends. It is calculated as:

Dividend Yield

Why It Matters:

- Indicates the income potential of a stock.

- Higher yields may signal a strong cash flow but could also indicate risk.

- Useful for income-focused investors.

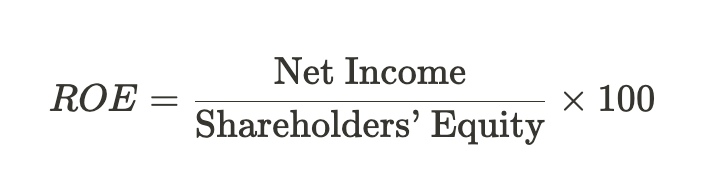

5. Return on Equity (ROE)

ROE measures how efficiently a company generates profits from shareholders' equity. It is calculated as:

Return on Equity (ROE)

Why It Matters:

- A higher ROE suggests strong management and profitability.

- Helps compare profitability across companies.

- A declining ROE may signal operational inefficiencies.

6. Debt-to-Equity (D/E) Ratio

The D/E ratio assesses a company's financial leverage by comparing total debt to shareholders' equity. The formula is:

Debt-to-Equity (D/E) Ratio

Why It Matters:

- A high D/E ratio indicates high leverage, which may increase financial risk.

- A low D/E ratio suggests financial stability but could indicate underutilized growth potential.

- Important for evaluating companies in capital-intensive industries.

7. Free Cash Flow (FCF)

FCF represents the cash available to a company after capital expenditures. It is calculated as:

Free Cash Flow (FCF)

Why It Matters:

- Indicates financial flexibility and ability to reinvest or pay dividends.

- Positive FCF is a good sign of financial health.

- Negative FCF may indicate growth investments or financial distress.

8. Price-to-Sales (P/S) Ratio

The P/S ratio compares a company’s stock price to its revenue per share. It is calculated as:

Price-to-Sales (P/S) Ratio

Why It Matters:

- Useful for evaluating startups or companies with inconsistent earnings.

- Lower P/S ratios may indicate undervaluation.

- Best used alongside other metrics.

9. Beta (β) – Measuring Volatility

Beta measures a stock’s volatility compared to the market.

Why It Matters:

- β > 1: The stock is more volatile than the market.

- β < 1: The stock is less volatile than the market.

- Helps investors assess risk tolerance.

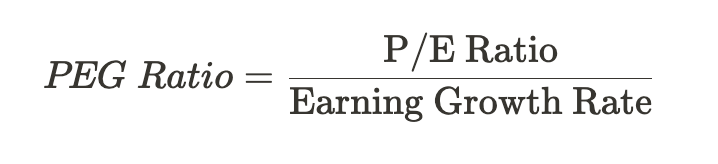

10. PEG Ratio (Price/Earnings to Growth Ratio)

The PEG ratio adjusts the P/E ratio for a company’s expected growth. It is calculated as:

PEG Ratio (Price/Earnings to Growth Ratio)

Why It Matters:

- A PEG ratio below 1 suggests an undervalued stock.

- Accounts for growth potential unlike the standard P/E ratio.

- Helps investors find high-growth opportunities.

Conclusion

Understanding stock market metrics like P/E ratio, EPS, ROE, and others is essential for making informed investment decisions. No single metric tells the full story, so it's crucial to analyze multiple ratios together and compare them within the same industry. Whether you're a beginner or a seasoned investor, mastering these financial indicators can enhance your ability to identify high-quality stocks and build a profitable portfolio.

By combining these metrics with broader market trends, industry research, and company fundamentals, you can make smarter and more strategic investment choices.