Financial fraud is a growing concern for banks, fintech companies, and online payment platforms like PayPal. With the rise of digital transactions, fraudsters have become increasingly sophisticated, exploiting security loopholes and leveraging technology to commit crimes. To combat this, artificial intelligence (AI) has emerged as a powerful tool in detecting and preventing fraud. But can AI truly stop scammers? Let’s explore how AI is reshaping financial security and whether it can outsmart fraudsters in the long run.

The Growing Threat of Financial Fraud

The Digital Age and Fraud Evolution

The rapid adoption of digital banking, e-commerce, and contactless payments has created new opportunities for cybercriminals. Fraudulent activities such as identity theft, phishing scams, credit card fraud, and money laundering cost businesses billions annually. According to a report by Juniper Research, online payment fraud losses are projected to exceed $343 billion between 2023 and 2027. In 2022 alone, global losses due to payment fraud reached $41 billion, with a projected increase to $48 billion by 2025.

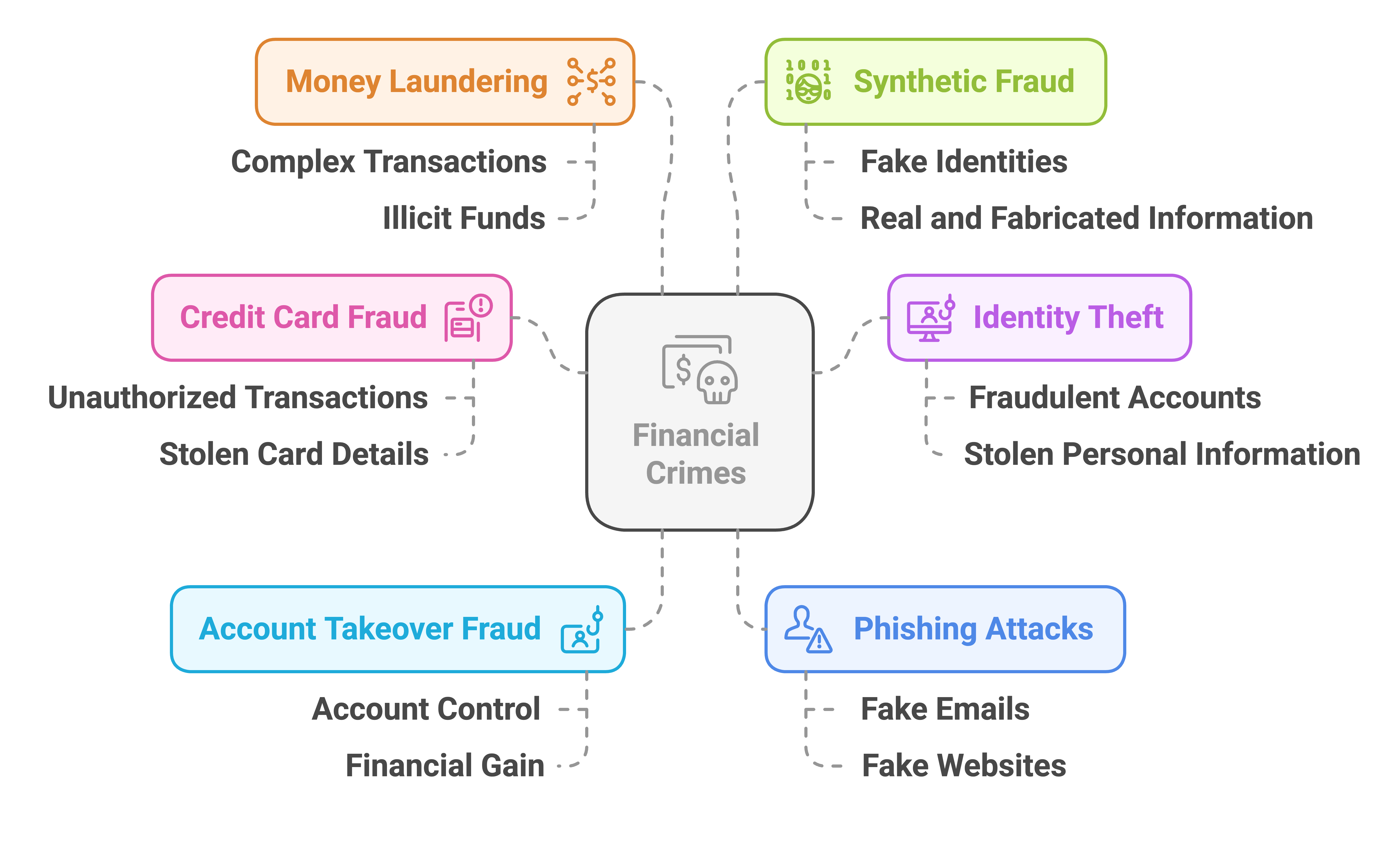

Common Types of Financial Fraud

Credit Card Fraud – Unauthorized transactions made using stolen card details.

Identity Theft – Using stolen personal information to open fraudulent accounts.

Account Takeover Fraud – Gaining control over legitimate accounts for financial gain.

Phishing Attacks – Tricking individuals into providing sensitive information through fake emails or websites.

Money Laundering – Concealing the origins of illicit funds by passing them through complex transactions.

Synthetic Fraud – Creating fake identities using a combination of real and fabricated information.

Understanding Financial Crimes: Types and Implications

With cybercriminals constantly refining their tactics, traditional rule-based fraud detection systems struggle to keep up. This is where AI steps in.

How AI is Transforming Fraud Detection

Machine Learning and Pattern Recognition

AI-driven fraud detection systems use machine learning algorithms to analyze vast amounts of transaction data. Unlike traditional rule-based systems, which rely on predefined fraud indicators, AI models can:

- Identify patterns and anomalies in real-time.

- Learn from historical fraud cases to detect emerging threats.

- Reduce false positives by differentiating between legitimate and suspicious transactions.

For example, banks use AI-powered models to detect unusual spending behavior, such as a sudden large transaction from a foreign location, and flag it for further review. According to a McKinsey report, AI-driven fraud detection systems have reduced fraud losses by up to 50% in some financial institutions.

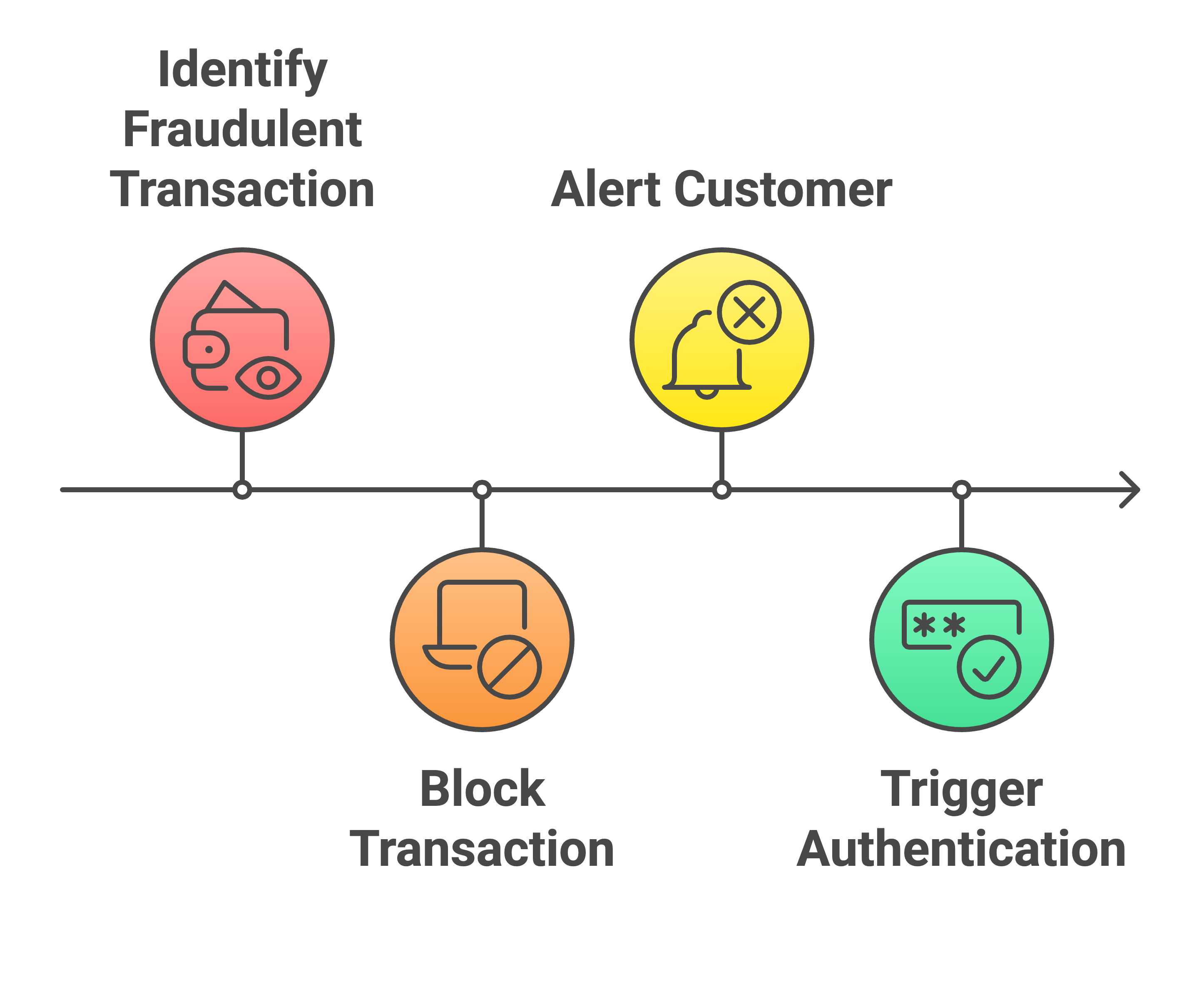

Real-Time Fraud Detection and Prevention

AI enhances fraud prevention by enabling real-time transaction monitoring. PayPal, for instance, uses AI to analyze millions of transactions daily, identifying suspicious activities within seconds. This allows companies to:

- Block fraudulent transactions before they are completed.

- Alert customers about suspicious activities on their accounts.

- Automatically trigger additional authentication steps for high-risk transactions.

Fraud Prevention and Customer Alert Process

Biometric Security Measures

AI-driven biometric authentication methods, such as facial recognition, voice recognition, and fingerprint scanning, add an extra layer of security. Many fintech companies and banks now use AI-powered biometric verification to:

- Prevent unauthorized account access.

- Reduce reliance on passwords, which can be easily compromised.

- Enhance identity verification in digital transactions.

Natural Language Processing (NLP) in Fraud Prevention

AI’s NLP capabilities help detect phishing attempts and fraudulent communications by analyzing:

- Email and text message content for scam indicators.

- Social engineering patterns used by fraudsters.

- Fake reviews and online scams targeting consumers.

For instance, AI models can analyze email metadata and language patterns to detect phishing attempts before they reach a user’s inbox. According to the Anti-Phishing Working Group (APWG), phishing attacks increased by 150% in 2021, highlighting the need for AI-driven detection systems.

Behavioral Analytics: Understanding User Habits

AI-powered behavioral analytics track users’ typical spending patterns and device usage to detect anomalies. If a customer who usually shops in New York suddenly makes a high-value purchase from an unknown IP address in Asia, AI systems can flag the transaction as suspicious.

AI in Anti-Money Laundering (AML) Compliance

Financial institutions are legally required to monitor transactions for money laundering activities. AI assists in AML compliance by:

- Identifying suspicious transaction chains.

- Detecting shell companies used for illicit activities.

- Automating reporting for regulatory authorities.

By streamlining AML processes, AI helps banks and fintech firms stay compliant while reducing operational costs. A study by the Financial Action Task Force (FATF) found that AI-based AML solutions improve detection accuracy by up to 80% compared to traditional methods.

The Challenges of AI in Fraud Detection

Evasion Techniques by Fraudsters

As AI improves, so do fraudsters’ tactics. Criminals constantly test AI systems to find loopholes, using techniques such as:

- Adversarial AI – Creating fake data patterns to mislead machine learning models.

- Deepfake Fraud – Using AI-generated synthetic identities to bypass verification.

- Automated Fraud Bots – Deploying AI-driven bots to conduct large-scale fraud attacks.

Ethical and Privacy Concerns

AI-driven fraud detection raises concerns about data privacy, potential biases, and the ethical use of customer data. Some key challenges include:

- False Positives and Negatives – AI may wrongly flag legitimate transactions or fail to detect sophisticated fraud.

- Bias in AI Models – Training data may introduce biases, leading to discrimination against certain demographics.

- Regulatory Compliance – Financial institutions must ensure AI models comply with privacy laws such as GDPR and CCPA.

The Future of AI in Financial Fraud Prevention

AI-Powered Collaboration Between Banks and Fintechs

To stay ahead of fraudsters, banks and fintech companies are collaborating to share fraud intelligence using AI-driven networks. By pooling data across institutions, AI models can:

- Detect fraud trends across multiple platforms.

- Prevent cross-border financial crimes.

- Improve accuracy through collective intelligence.

The Role of Explainable AI (XAI)

Explainable AI (XAI) aims to make AI decision-making more transparent, allowing banks to:

- Understand why a transaction was flagged as fraudulent.

- Improve trust and regulatory compliance.

- Enhance customer communication regarding fraud alerts.

AI-Driven Blockchain Solutions

Blockchain and AI are being integrated to enhance fraud prevention. AI can:

- Detect anomalies in blockchain transactions.

- Strengthen smart contract security.

- Reduce fraud in decentralized finance (DeFi) platforms.

Can AI Fully Stop Financial Fraud?

While AI significantly enhances fraud detection and prevention, it is not a foolproof solution. Fraudsters will continue to adapt, requiring ongoing advancements in AI technology. The most effective approach is a hybrid model where AI works alongside human fraud analysts to:

- Provide real-time fraud insights.

- Enhance manual investigation with AI-powered tools.

- Continuously refine fraud detection models to stay ahead of emerging threats.

Conclusion

AI is playing a crucial role in the fight against financial fraud, offering real-time detection, behavioral analytics, biometric security, and AML compliance. However, it is not a silver bullet. Financial institutions must balance AI innovation with ethical considerations and regulatory compliance to ensure security without compromising customer trust. The battle against fraud is ongoing, but with AI in their arsenal, banks, fintech companies, and payment platforms have a powerful weapon against scammers.