Introduction

Investing is often perceived as a rational and data-driven process. However, emotions and psychological biases frequently influence investor behavior, leading to irrational decisions that can impact market outcomes. Behavioral finance is a field that examines these biases and their effects on financial decision-making. Understanding these psychological tendencies can help investors make more informed, rational choices and improve their overall financial outcomes.

What is Behavioral Finance?

Behavioral finance is the study of how psychological influences and cognitive biases affect investors and financial markets. Unlike traditional finance theories that assume investors act rationally, behavioral finance recognizes that emotions, heuristics, and social influences often drive decision-making.

Key Psychological Biases in Investing

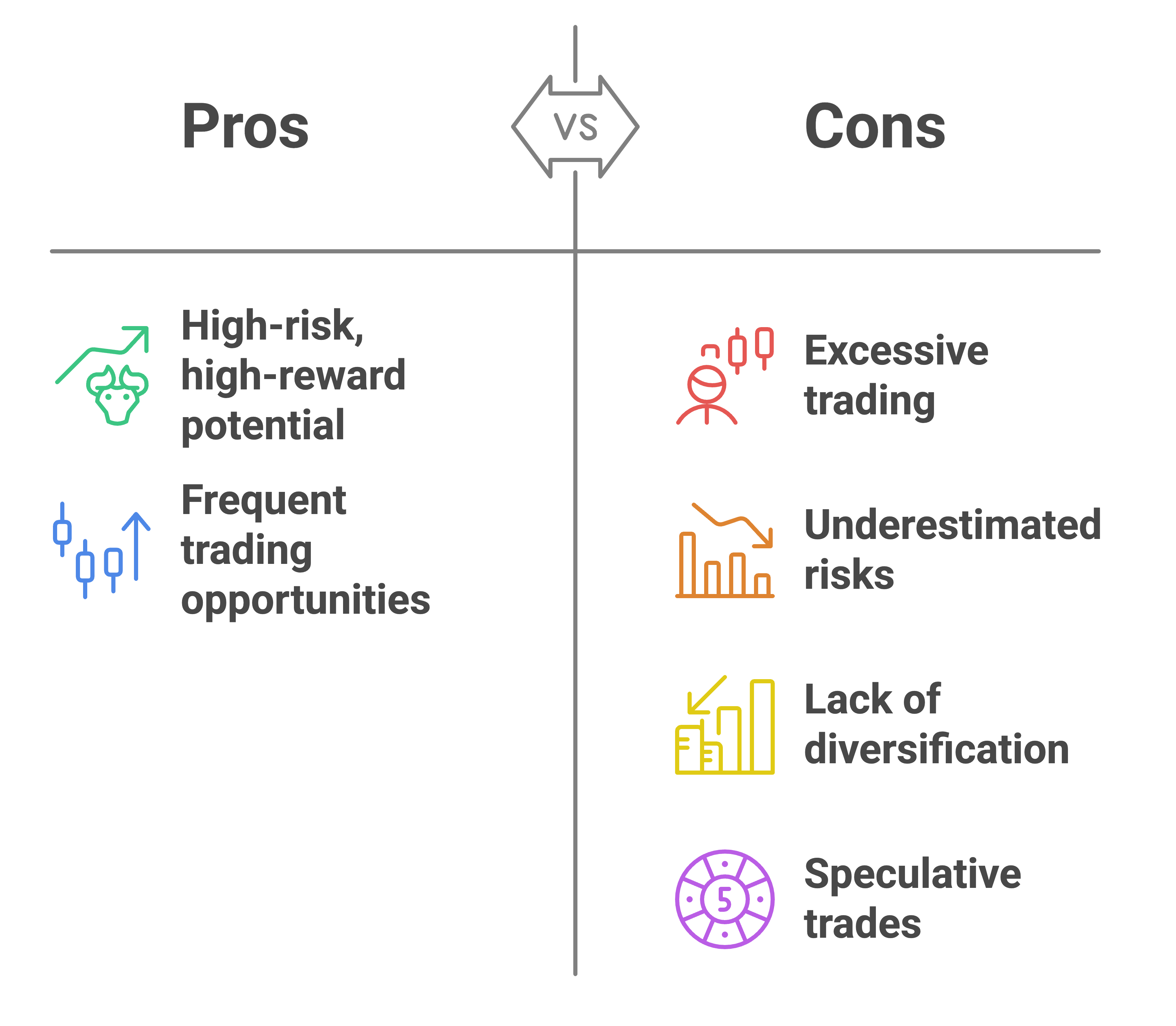

1. Overconfidence Bias

- Definition: Investors overestimate their knowledge and abilities, leading to excessive risk-taking.

- Impact: Overconfident investors may trade too frequently, underestimate risks, or fail to diversify portfolios.

- Example: A trader who believes they can consistently time the market may ignore fundamental research and make speculative trades.

Overconfidence Bias

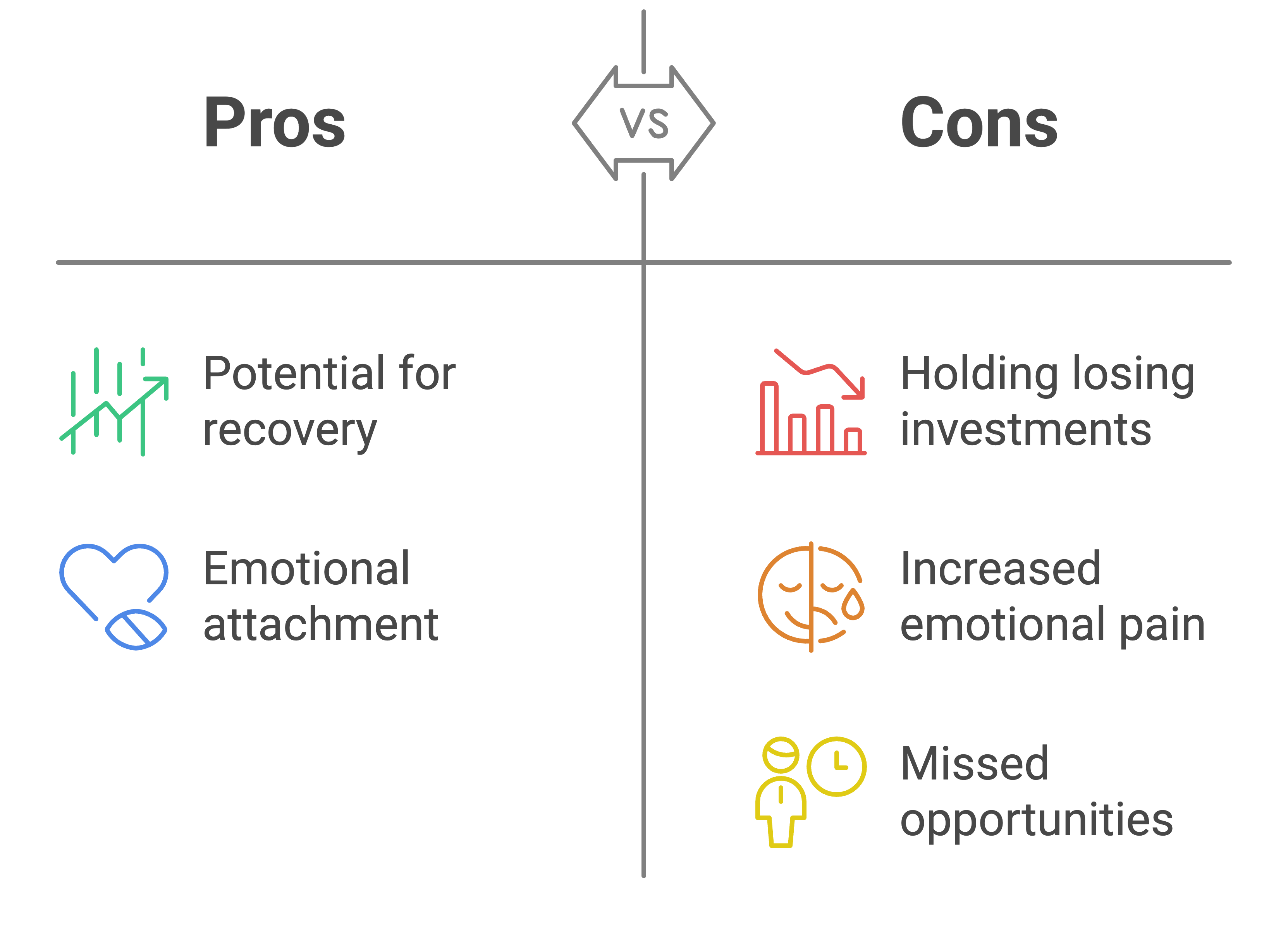

2. Loss Aversion

- Definition: Investors feel the pain of losses more acutely than the joy of equivalent gains.

- Impact: Leads to holding losing investments too long in the hope of breaking even.

- Example: An investor refuses to sell a declining stock due to the emotional discomfort of realizing a loss.

Loss Aversion

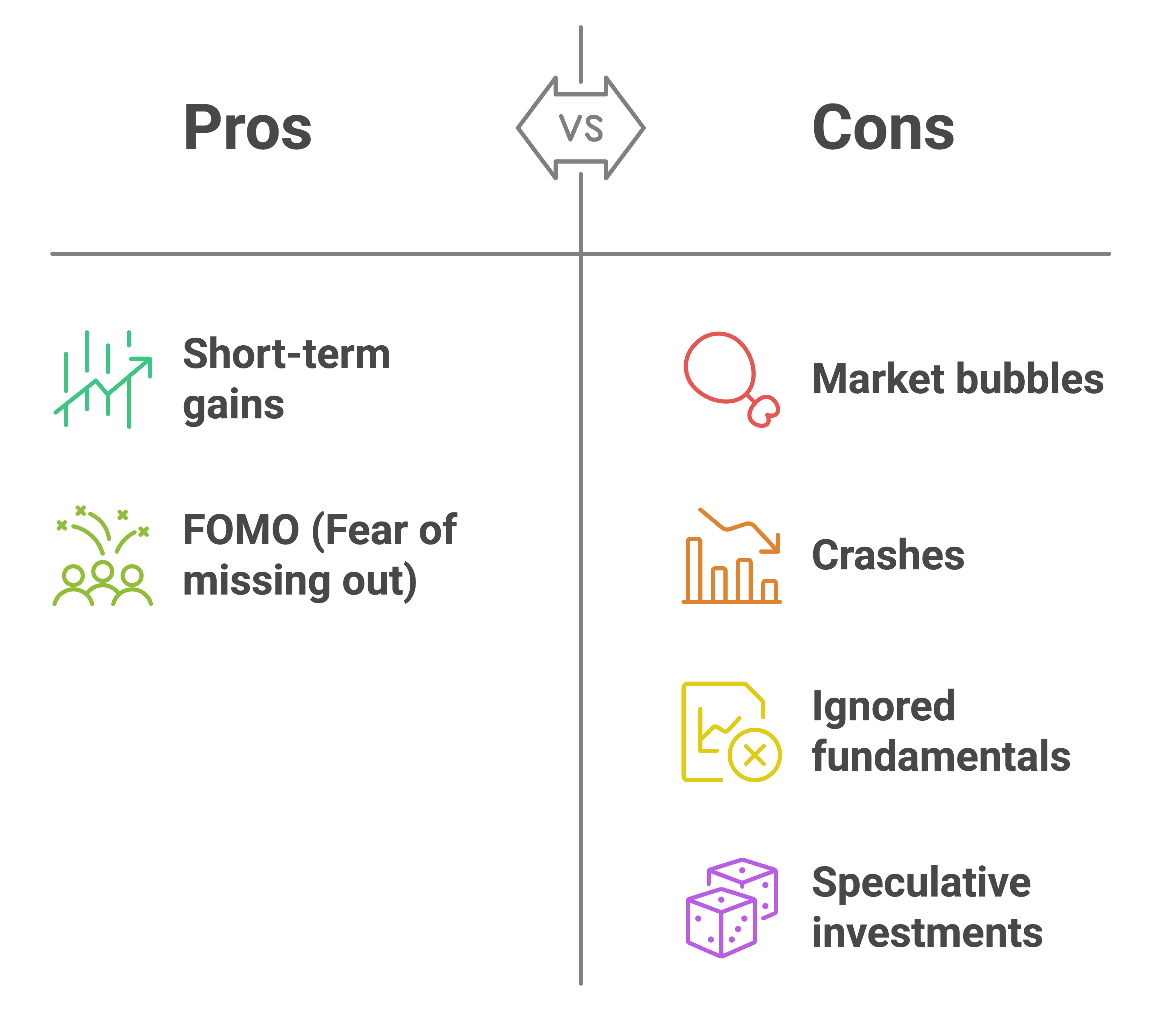

3. Herd Mentality

- Definition: Investors follow the crowd rather than relying on their own analysis.

- Impact: Causes market bubbles and crashes as people buy into trends without evaluating fundamentals.

- Example: The dot-com bubble saw investors pouring money into internet stocks simply because others were doing the same.

Herd Mentality

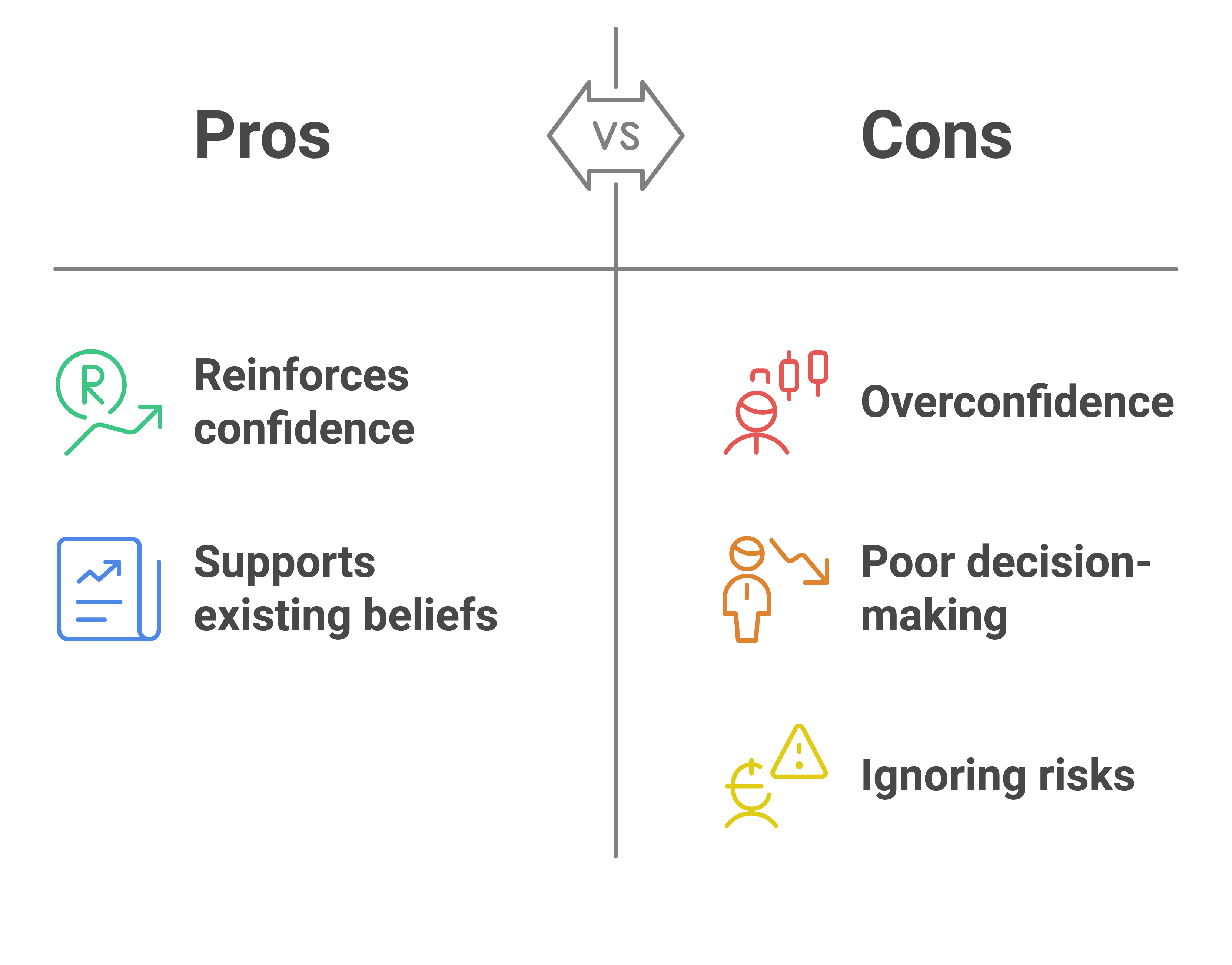

4. Confirmation Bias

- Definition: Investors seek information that supports their existing beliefs while ignoring contradictory data.

- Impact: Leads to overconfidence and poor decision-making.

- Example: An investor bullish on cryptocurrency only reads positive news about Bitcoin, ignoring warnings of high volatility.

Confirmation Bias

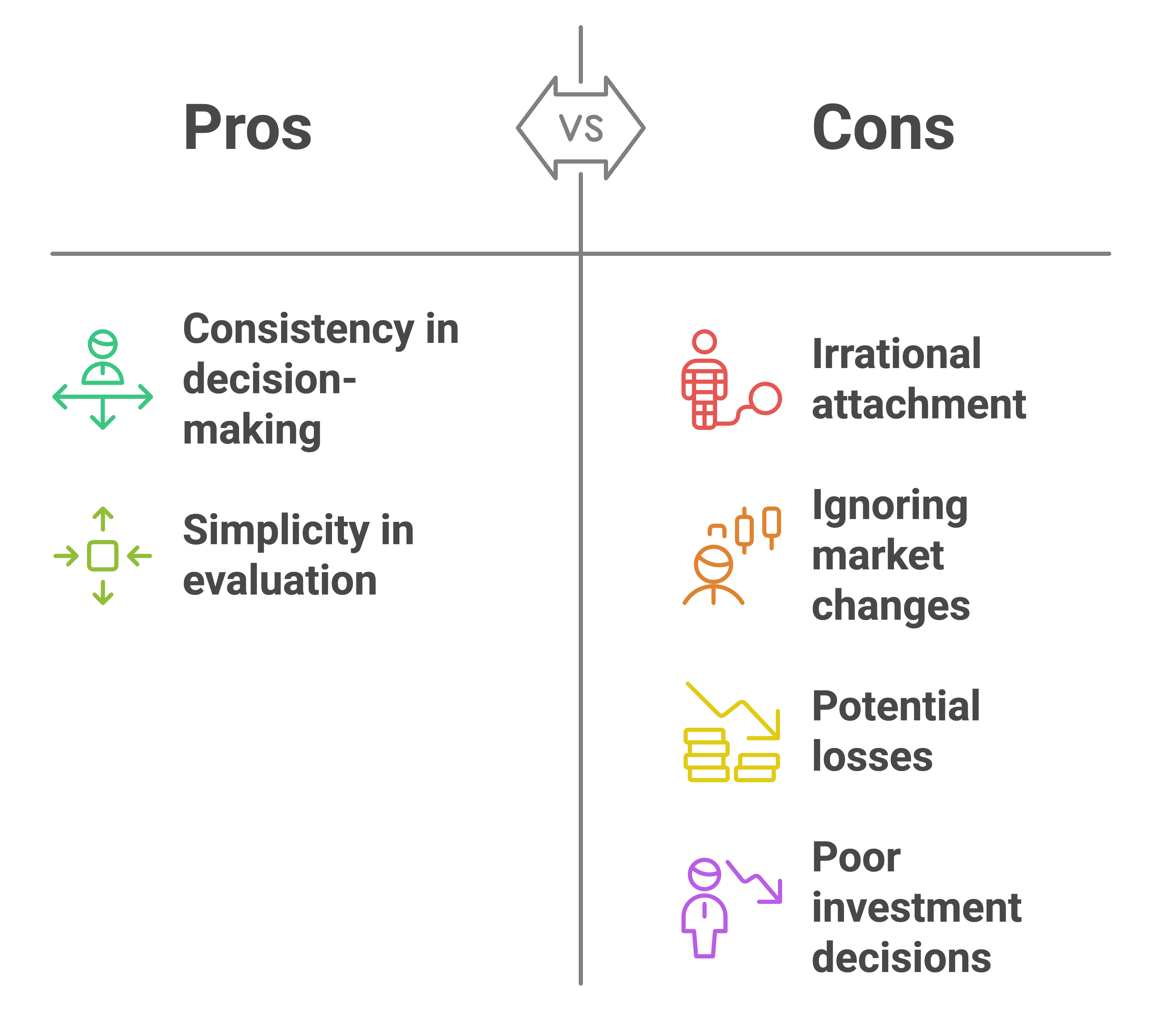

5. Anchoring Bias

- Definition: Investors fixate on an initial price or piece of information when making decisions.

- Impact: Causes irrational attachment to past prices rather than current market realities.

- Example: A stock bought at $50 is still viewed as worth that amount, even if its market price has fallen to $30.

Anchoring Bias

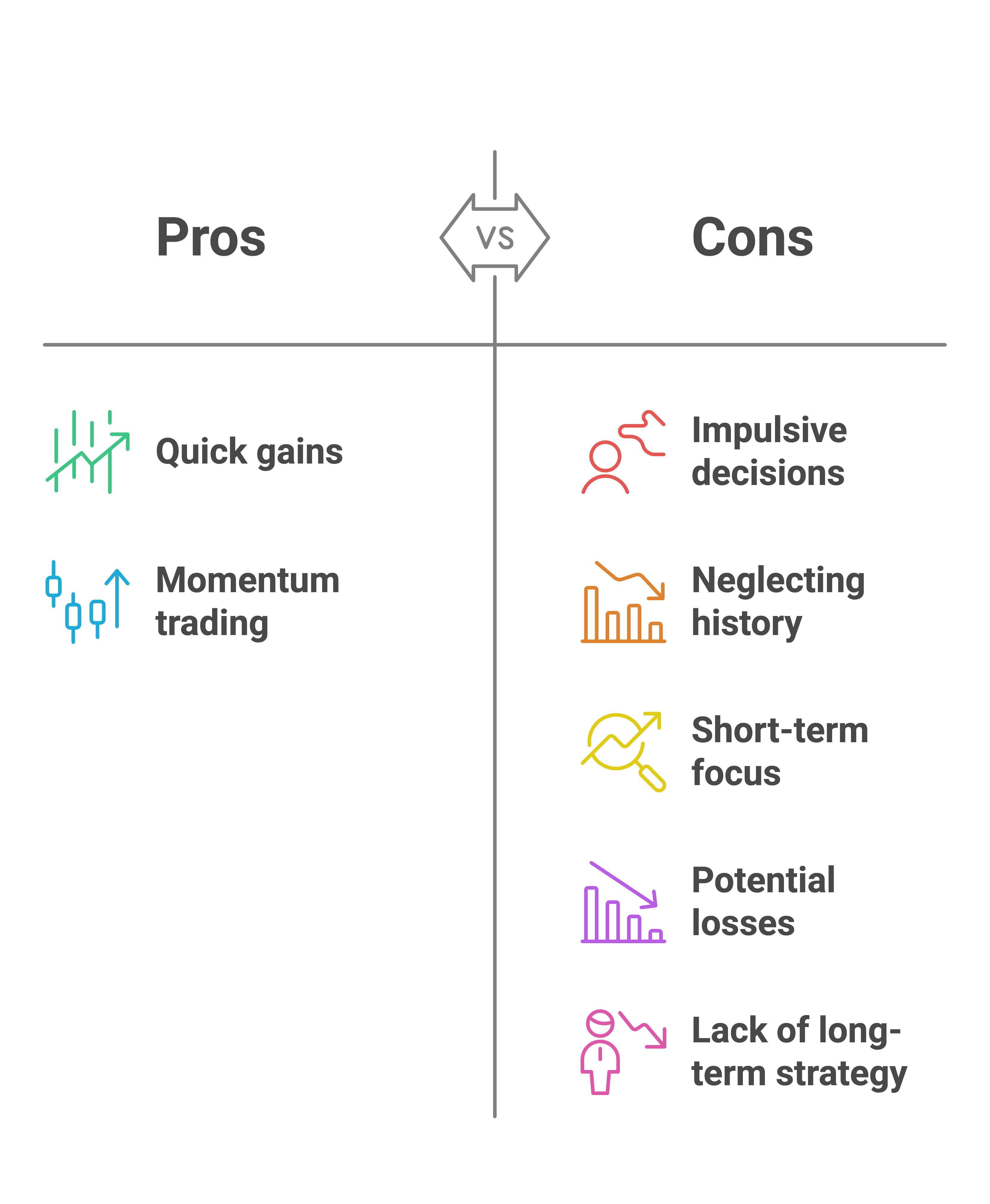

6. Recency Bias

- Definition: Investors place too much weight on recent events and trends while neglecting historical data.

- Impact: Leads to impulsive investment decisions based on short-term performance.

- Example: Buying a stock solely because it has risen sharply in the past few months without assessing long-term potential.

Recency Bias

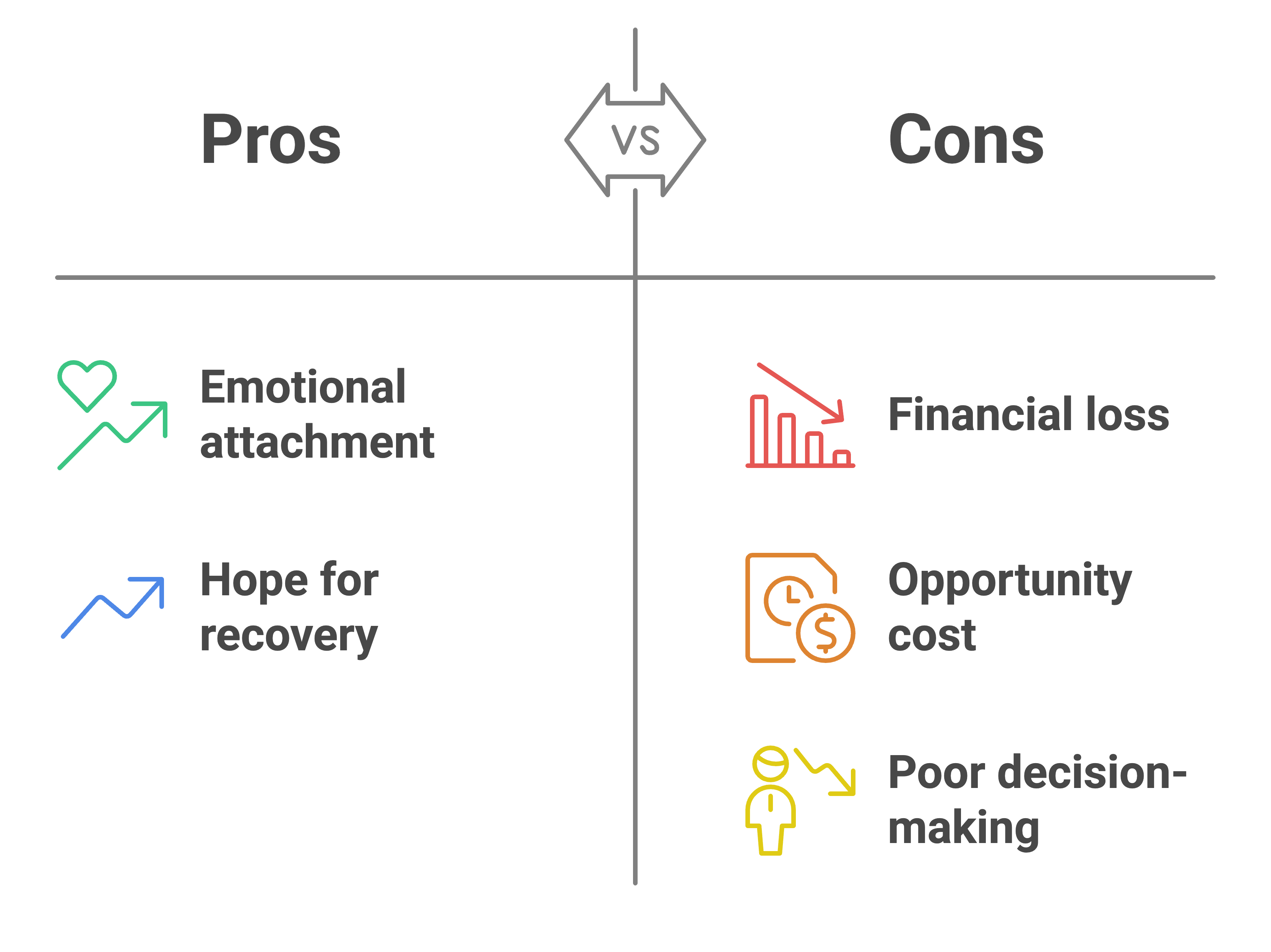

7. Sunk Cost Fallacy

- Definition: Investors continue holding an investment based on past investments rather than future potential.

- Impact: Leads to sticking with losing positions longer than necessary.

- Example: Holding onto a failing stock because of the large amount already invested in it.

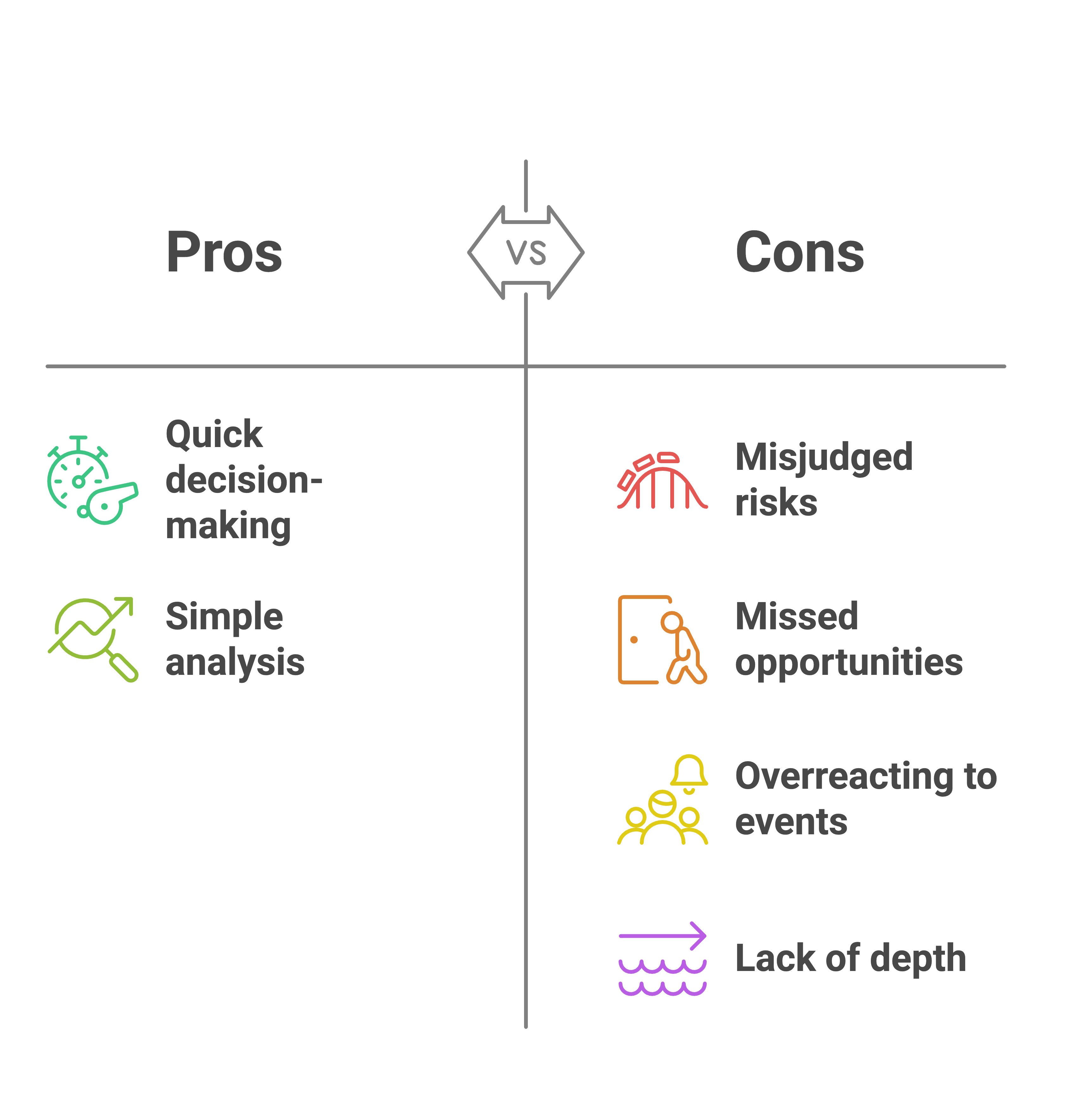

8. Availability Heuristic

Sunk Cost Fallacy

- Definition: Investors rely on easily accessible information rather than thorough analysis.

- Impact: Leads to misjudging risks and opportunities.

- Example: Avoiding airline stocks after hearing about a single high-profile plane crash despite statistical safety data.

Availability Heuristic

How to Overcome Psychological Biases

1. Develop a Disciplined Investment Strategy

- Use objective criteria such as fundamental analysis rather than emotions to guide decisions.

- Stick to a well-defined investment plan to avoid impulsive reactions.

2. Diversify Investments

- Spreading investments across different assets reduces exposure to emotional decision-making and market volatility.

3. Seek Contrarian Perspectives

- Actively look for information that challenges existing beliefs to counter confirmation bias.

4. Use Stop-Loss Orders

- Implementing automatic sell orders at predetermined levels can help prevent loss aversion from affecting decisions.

5. Limit Trading Frequency

- Excessive trading often results from overconfidence and can lead to poor long-term returns.

6. Maintain a Long-Term Perspective

- Avoid making decisions based on short-term market movements and focus on overall financial goals.

Conclusion

Understanding behavioral finance and the psychological biases that influence investor behavior can lead to better financial decision-making. By recognizing these tendencies and implementing strategies to counteract them, investors can improve their ability to make rational, informed choices. Overcoming emotional impulses and cognitive biases is essential for long-term success in the financial markets.

Key Takeaway: Awareness of behavioral biases is the first step toward better investing. Stay disciplined, objective, and patient to achieve financial success.